CECL WARM Method – What to Know and How to Use It

Presenters: Baker Eddraa and Jared Mill

Among recent CECL developments has been the introduction of a new methodology, the Remaining Life or WARM/WARL method. Some questions that financial institutions may be having are as follows: Where did the methodology come from? What types of institutions should leverage it? Which pools are best for making a remaining life calculation?

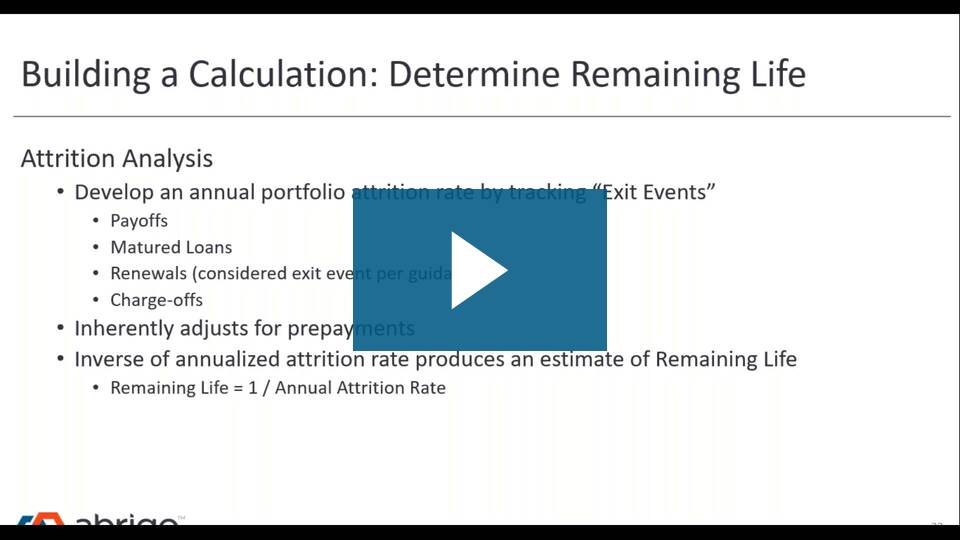

The remaining life methodology first surfaced during the “Ask the Regulators” webinar in February 2018. The methodology uses call report, external, or peer data to guide decision-making. It incorporates similar principals to a discounted cash flow approach and it’s an acceptable solution for institutions who are less complex and may have a lack of loan-level data or loss history.

In this webinar, hear from Abrigo Advisory Services members and CPAs Jared Mills and Baker Eddraa as they discuss in more detail the pros and cons of the remaining life methodology and guide institutions on when they should be using it for CECL.

Join to learn:

- Context on the remaining life methodology and its basic premises

- What types of institutions that the remaining life methodology will be well-suited for

- When and when not to leverage the remaining life methodology

- Feedback from clients and prospects who have tested so far