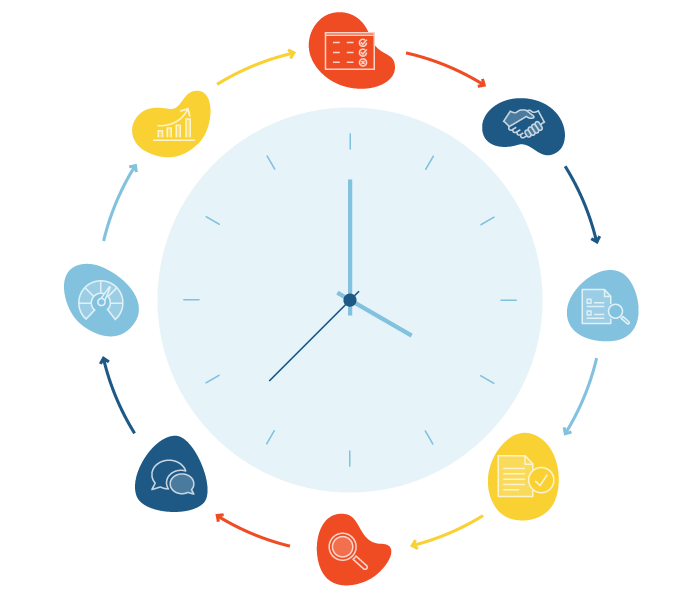

Sageworks Workflow interacts with other solutions to create an end-to-end solution that reduces inefficiency and exceptions. Streamline and track progress for the life of the loan: data entry, loan origination, underwriting, approval, annual reviews, borrower correspondence, stress tests and impairment.

Credit Risk Software

- Credit Analysis

- Risk Rating

- Loan Pricing

- Loan Administration

- Document Preparation

- Electronic Tax Return Reader

- Workflow

- Document Management

- Analytics and Reporting

Get Updates from Abrigo

SubscribeKeep Me Informed

Stay up-to-date on industry knowledge and solutions from Abrigo.

Streamline Life-of-Loan Processes

Workflow

Workflow

Shorten Loan Turnaround Time

- Customize workflows to match your loan management needs

- Use notifications to prompt next steps and reduce stall time and bottlenecks

- See all the information related to a borrower in one, centralized place

- Use if/then and conditional logic in the development of workflow templates to match existing credit policy to automation

- Document each step of the process for better auditability

A tool that shortens loan turnaround time? Now that's big.

Let's talk about how we can help you.

Get started

[Sageworks Workflow is] a platform that would allow us to include our internal communications…make it so that, very quickly, lenders, credit analysts and managers could easily see where a deal was at in the process, what had been done and what still needed to be done. It allowed us to streamline our approval process and move away from paper, signatures, copying, and scanning and all that stuff. We now use the system as an electronic credit approval, and that’s working quite well for us. It allows us to very quickly respond to our customers’ requests.

Lisa Eberding, CCO | Marine Bank