Abrigo's new lending solution provides consistent, guided workflows and the data insights you need. Configurable role-based dashboards, a robust deal summary page, and built-in reports help you process loan requests, manage pipeline, and close deals faster.

Lending and Credit Risk

- Community Lending

- Commercial Lending Software

- Consumer Lending Software

- Small Business Lending Software

- Construction Lending

- Credit Risk Software

Get Updates from Abrigo

SubscribeKeep Me Informed

Stay up-to-date on industry knowledge and solutions from Abrigo.

Easy-to-use lending solution

Book more loans faster and expand your

customer relationships

Powerful yet simple

Community financial institutions face challenges on all fronts. Whether it is managing in the current economic environment, keeping up with changing needs of customers, finding staff, or meeting growth goals, there is a lot going on. Abrigo Community Lending is a new lending solution designed for small banks and credit unions. It’s easy to implement, learn, and use.

Play VideoFeatures and functionality of Community Lending Software

Make fast, accurate, and compliant loan decisions

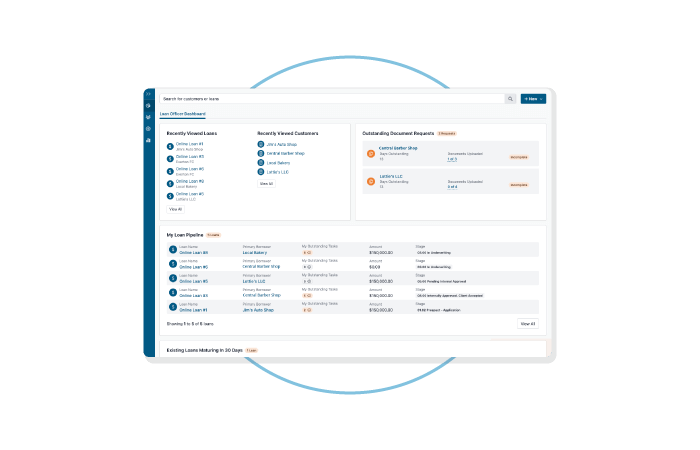

Lender control panel

Enable lending, underwriting, and administrative teams to easily see essential information and required tasks by role to book more loans faster.

Built-in reports

Easily access your institution’s data to make better real-time decisions with built-in reports that track lending pipeline, exposure, and more.

Multiple loan types

Equip teams with consistent processes across multiple loan types, including small business, commercial, consumer non-real estate, and agriculture.

-

Enhance the borrower experience

Offer customers the choice of filling out an easy-to-use loan request form on any mobile device or in the branch to eliminate back-and-forth communications and get them funds faster.

-

Simplified implementation

Get up and running quickly with minimal impact to your team and IT resources with our abridged training and best practice templates.

Technology you need

A recent survey by Abrigo found that 70% of community financial institutions value “ease of use” most when considering a lending solution.

Advantages of working with Abrigo

Ensure success by leveraging our industry expertise and collaborating with our community

Abrigo Community Lending software includes everything a community financial institution needs to grow without unnecessary complexity. We help ensure your success with a powerful software platform that scales with you, the opportunity to work with our industry experts, and the ability to collaborate with our community of more than 80,000 financial professionals.

Scalable solution

Abrigo knows loan growth is a top objective at financial institutions across the country. Using our lending solution, banks and credit unions can leverage our web-based platform and easy-to-use templates to ensure loan policy consistency as your volume and footprint expand.

Dedicated partnership

Abrigo provides best-in-class customer and advisory services to help you achieve your growth and technology goals. Our team of knowledgeable individuals works with you to make sure you successfully implement your lending solution and will be here to answer any questions you may have.

Integrated systems with Abrigo

Automate client correspondence and key administration processes

Loan Administration

Financial institutions’ loan administration processes can be tedious. Abrigo’s loan administration software helps institutions overcome this by simplifying portfolio management through the automation of key tasks, such as building client correspondence and managing ticklers.

Resources on Community Lending Software

Lending software buyer's guide

This guide will review the key areas FI leaders should consider when making lending software investments.

Big challenges and big opportunities for CFIs

Leverage unique advantages to leapfrog competitors and better serve your communities.

Banking tech: Why invest now, not later

Amid market pressures, remember the benefits of investing in tech for customers and internal staff.