Abrigo has been a leading source of information and assistance for financial institutions on the PPP, helping them as they originated loans in their communities. Abrigo also helps PPP lenders process and handle reporting on borrowers' loan forgiveness applications and submit PPP forgiveness requests to the Small Business Administration.

PPP Resources for Financial Institutions

Guidance for the SBA Paycheck Protection Program

The PPP Landscape

Financial institutions have helped small businesses access nearly $800 billion in funding through the SBA's Paycheck Protection Program (PPP) since the CARES Act was passed.

Abrigo has been a critical PPP partner to lenders since the beginning and can help you support your communities in this time of need. As we demonstrated in early 2020, we adapt our technology to an ever-changing regulatory environment and keep you informed of all the landscape changes.

Stay Up-to-Date

Latest PPP Lender Resources

Helping Financial Institutions Throughout the Entire Life of PPP Loans

-

Originating PPP loans

-

Navigating PPP loan forgiveness

-

Submitting 1502 reports

-

Submitting PPP forgiveness requests to SBA

-

Reporting on your PPP portfolio

-

Ongoing PPP support and expertise

Abrigo is Here to Help

Automate the PPP application process with a digital application.

learn more

Abrigo SBA Lending Solution handles PPP loans for small businesses

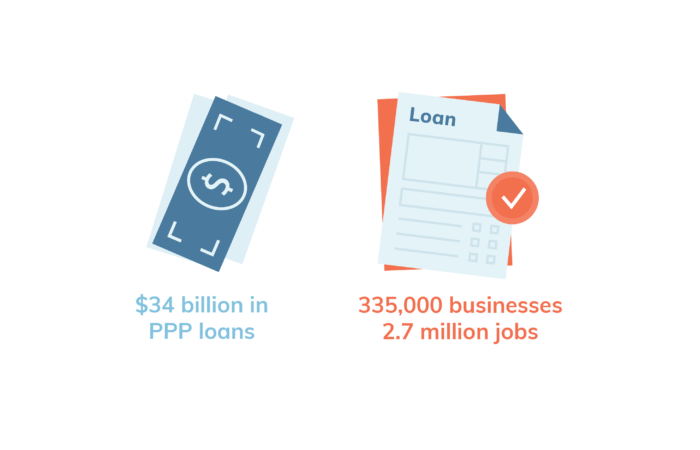

Financial institution customers of Abrigo's SBA Lending Solution have handled over 545,000 loan applications through the Small Business Administration’s Paycheck Protection Program (PPP) since April 3, 2020. Separately, lenders using Abrigo’s solutions have so far helped borrowers receive SBA forgiveness for PPP loans totaling $40 billion.

3 Steps to Participate in the

Paycheck Protection Program

PPP Origination

Automate the origination process to get capital into the hands of small business owners quickly. Abrigo can digitize lending through online loan applications, E-Tran integration, e-sign capabilities, and more.

Get Resources

PPP Forgiveness

Loan forgiveness is a key draw to the PPP for borrowers and lenders. Accurately calculate and apply PPP forgiveness guidelines with Abrigo's automated forgiveness solution. Submit forgiveness requests to the SBA.

Get Resources

PPP Reporting & Administration

Where are PPP loans in the pipeline? Abrigo's reporting and administration tools enable institutions to produce specific PPP dashboards and reports, as well as generate and submit 1502 reports.

Get Resources “Because the information seems to be constantly changing, it’s reassuring to be working with a partner that is not only staying on top of the changes but is also collaborating with other banks to make the right solution.”

Brett Dutcher, Sr. Information Technology Manager, Greenstone Farm Credit Services

Partner with Abrigo Today

State Banking Associations Endorsements

Multiple state banking associations have endorsed Abrigo’s Paycheck Protection Program (PPP) Forgiveness and Administration solution, part of the Sageworks SBA Lending Solution, to aid their member banks in streamlining the loan forgiveness and administration process. Learn more.

Implement Abrigo's PPP Origination Solution within 48 hours.

Let's Work togetherMore PPP Origination Resources

Blogs

- Stopping PPP Fraud

- As Anti-Fraud Efforts Continue, Borrowers & Lenders Face Challenges

- The PPP Extension: 10 Things Lenders Need to Know

- Lender Guidance Details How Borrowers Apply for a Second Draw Loan

- After PPP Can Help Banks, Credit Unions Grow, Mitigate Risk

- SBA Uses Do Not Pay List to Thwart Further PPP Fraud

- How the Pandemic and PPP Have 'Turbo-Charged' New Business Lending Strategies

- CDFIs Kick off PPP Submissions; Registering for SAM.gov

- All of our blog posts on PPP

Webinars

- Detecting PPP Fraud: Optimizing Your AML Solution

- How CDFIs Can Support Their Communities Through PPP: A Success Story

- What's Changed with PPP in 2021?

- Profitability of PPP and Funding Options for Lenders

Other Resources

- PPP Fraud Detection Checklist: Key Due Diligence Elements to Review

- How Does a Borrower Qualify for a Second Draw Loan (Infographic)

- First Draw vs. Second Draw Loans (Infographic)

- CDFI Community Bank of the Bay 'Ready to Go' for PPP

- Beyond PPP: Propel Growth & Profitability with Technology

- Paycheck Protection Program Timeline for Lenders

More Resources on PPP Forgiveness and Administration

Blogs

- Updated forgiveness forms, guidance issued

- PPP Instructions for SBA Forms 3509, 3510 Released on Forgiveness Platform

- PPP Lenders Starting to See Payments from SBA

- SBA Now Processing PPP Forgiveness Decisions, Payments

- Key Lender Steps Before Using the SBA's PPP Forgiveness Platform

- PPP Forgiveness Platform Opens Aug. 10: Here's the 411

- New PPP 3508 EZ Form Released

- How Are PPP Loans Forgiven?

Latest Guidance

SBA and Treasury Resources

NEWEST: IFR: COVID Revenue Reduction Score, Direct Borrower Forgiveness Process, and Appeals Deferment

PPP Guaranty Purchases, Charge-Offs, and Lender Servicing Responsibilities

FAQs for Lenders & Borrowers (Rev.4/6/21)

Second Notice of Revised Procedures for Addressing Hold Codes and Compliance Check Error Messages on PPP Loans

IFR-PPP as Amended by American Rescue Plan Act

IFR: Revisions to Loan Amount Calculation and Eligibility

IFR - Second Draw Loans

IFR - Loan Forgiveness Req's & Loan Review Procedures as Amended by Economic Aid Act

IFR - PPP as Amended by Economic Aid Act

Second Updated Guidance on Lender Processing Fee Payment & 1502

Reporting

Revised SBA PPP Procedures for Addressing Hold Codes on First Draw PPP Loans and Compliance Check Error Messages on First Draw Loans and Second Draw Loans

Registration Required for SAM.gov

SBA Procedural Notice 5000-20092: Revised Procedures for Addressing Hold Codes on First Draw PPP Loans and Compliance Check Error Messages on First and Second Draw Loans

SBA Takes Steps to Improve First Draw PPP Loan Review

Unresolved Borrowers: SBA Paycheck Protection Platform List of Hold Codes & Examples of Documentation to Assist in Resolving Them

SBA Paycheck Protection Platform Lender Instructions: Resolving First Draw Loan Hold Codes

SBA PPP Origination User Guide

Form 2483/Borrower Application(Rev.3/3)

Form 2483-SD/Second Draw Borrower Application (Rev.3/3)

Form 2484/Loan Guaranty (Rev.3/3)

Form 2484-SD/Second Draw Loan Guaranty (Rev.3/3)

SBA Form 3508 (PPP Loan Forgiveness Application & Instructions) (Rev. 1/19/21)

SBA Form 3508EZ & Instructions (Rev.1/19/21)

SBA Form 3508S & Instructions (Rev. 1/19/21)

SBA Forgiveness Platform User Guide for Lenders

Guidance on Assessing Capital for Minority, Underserved, Veteran, and Woman-Owned Business Concerns

FAQs about PPP Loan Forgiveness (10/13/20)

Treasury Factsheet for Borrowers (earlier rounds)

Treasury PPP Lender Facts (earlier rounds)

SBA Standard Loan Note (Form 147)

Other IFRs, procedural notices, forms from SBA

"It was a lifesaver. We are so grateful for this system."

Deborah Barstow, Senior Vice President | Enterprise Bank & Trust

Get started

Abrigo SBA Lending Solution

Reduce inefficient, manual processes involved in the SBA 7(a) lending process through the Abrigo solution. With streamlined underwriting and an E-Tran integration, our solution allows financial institutions to ramp up their SBA 7(a) lending efforts to support small businesses struggling due to the coronavirus.

Explore Abrigo's SBA Lending Solution

Stay Up-to-Date

Abrigo's Top PPP Resources

Unity Bank | See why Abrigo was the 'perfect partner' to help maximize PPP impact

Digital Capabilities Adopted for PPP: The ‘New Best Practices’ For Strongest Players

Read Aite Group Report