Why Choosing the Right Loss Rate Methodologies is the Largest CECL Concern

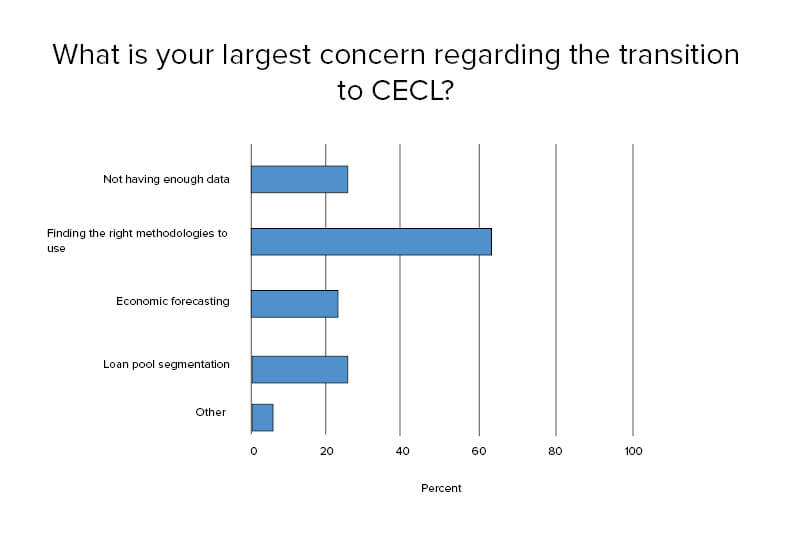

In a recent Abrigo webinar focused on loan pool segmentation, bank and credit union managers and executives were asked what their largest concern is in 2018 regarding the accounting standard transition from the incurred loss to the current expected credit loss model (CECL).

60% of respondents said finding the right methodologies to use when calculating their allowance is currently their largest concern regarding the transition.

Number of respondents = 220

Given that the CECL model is non-prescriptive, banks and credit unions have flexibility in choosing the right methodology for their institution’s unique data situation. This flexibility, combined with the fact that calculating an appropriate blend of methodologies is itself a daunting task given all the variables, often leads bankers to one simple question: Where do I begin?

Abrigo Risk Management Consultant Brandon Quinones, shared the following observation: “Institutions are having a difficult time selecting an appropriate loss rate methodology because there is somewhat vague regulatory direction in terms of which is the most appropriate given a certain set of circumstances. Some are more comfortable than others simply electing to go in a single methodology direction without considering the others, but there is some concern out there that regulators will expect institutions to justify why they didn’t select methodologies almost as much as why they selected the methodology in their model.”

In order to choose the right methodology, Abrigo Advisory Services recommends that an institution carefully analyze its portfolio performance and loss history for each line of business. This will require the engagement of both credit and risk management partners, reviewing an institution’s data collection resources and processes.

Before selecting a methodology, a financial institution should account for changes in credit policies, portfolio volume and management. Quantifiable research and documentation should be developed to support the decision of a methodology. Additionally, selecting different loss methods or periods across segments should be considered, if the portfolio analysis warrants it.

The webinar presenters recommended that a financial institution dig deep into their historic experience and leverage forecasting to place emphasis on periods with losses that were driven by characteristics that match future expectations.

Learn more about navigating the CECL transition.

How 2018 CECL concerns compare to 2017

In an Abrigo webinar conducted a year ago, 38.7% of the 200 bank and credit union managers and executives polled stated that capital concerns and worries about changes in reserve levels will cause the largest concern under CECL. The trend of financial institution concerns seem to have changed little in the past year, given that reserve levels are tied explicitly to methodology selection. Methodologies themselves are a tactical first step required prior to understanding appropriate reserve levels. In the two years since the CECL accounting standard was released in 2016, the financial industry has perhaps become more focused and disciplined in understanding how they must adopt these new standards.

“It’s difficult because there are no ‘best practices’ so far, other than to follow guidance considerations as closely as possible. It’s also difficult because it has been years since institutions have incurred significant losses on their books, so they are running into issues calculating anything at all. Even when leveraging peers, in some regions all of their peers have limited losses as well,” Abrigo Consultant Quinones stated. As the CECL adoption date approaches, institutions must ask questions like: Do we know the best approach? Do we have the resources to make the shift adequately for our institution and in line with the standard?

To learn more, download the Sageworks CECL prep kit.