Taking a vacation is often a well-deserved break, but for financial crime professionals, it can trigger significant stress. Fraud and AML/CFT suspicious activity monitoring is a cornerstone of any AML program and a critical part of a financial institution’s safety and soundness. However, compliance departments are frequently understaffed. Unexpected disruptions like turnover or family leave can exacerbate an already challenging workload for staff.

The situation becomes even more complex when seasonality or other events arise, such as:

- An AML or fraud staff member takes extended leave or has an unplanned exit from the team;

- An increased volume of specific suspicious activity alerts, such as during tax season or holiday retail months;

- A regulator requires a look-back of alerts to identify potential missed suspicious activity.

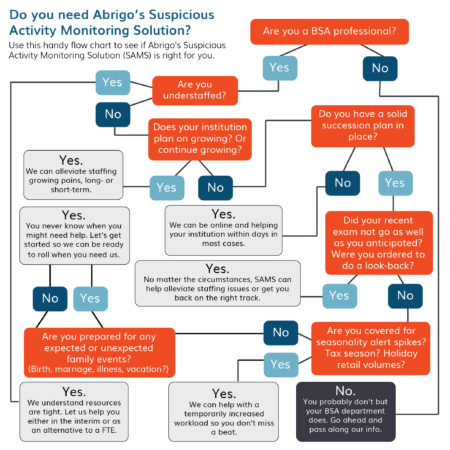

How would your institution manage this additional workload while maintaining compliance with daily deadlines? Do you have a backup AML staffing plan that ensures all regulatory requirements are met?

These challenges can feel overwhelming, but hitting the panic button is unnecessary. Abrigo’s Suspicious Activity Monitoring Services (SAMS) offers a practical, scalable solution to help institutions navigate both short-term and long-term staff augmentation needs. With a team of highly trained advisors, SAMS acts as an extension of your AML/CFT and fraud teams, seamlessly integrating to provide the expertise and monitoring you need without additional training.

With a Suspicious Activity Monitoring Services package, Abrigo assigns experienced financial crime professionals as project managers for the institution. Their goal is to help the institution where it needs it most: working alerts, investigating cases, writing SARs, conducting customer due diligence (CDD) reviews or high-risk reviews, or serving as an independent quality control arm for the institution. The concentration of work can change during the contract as the institution’s needs change.