Banking optimism hit a five-year high in 2017 among c-level executives at financial institutions, but this year, optimism took a sharp dip amidst concerns over decelerated loan growth, an uncertain economy, and higher interest rates, according to survey results by Cornerstone Advisors. Competition for deposits is high, but financial institutions are becoming savvier in finding ways to break through these banking slumps.

It wasn’t long ago that financial institutions were wary about the impact fintech would have on their traditional branches; however, fintech partnerships have become an integral part of many institutions’ success and growth. As financial institutions begin drawing up plans and goals for 2020, it’s important to consider the ways that fintech partnerships can help renew optimism and break through banking plateaus.

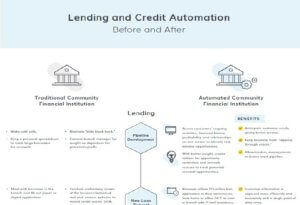

Top growth priorities for financial institutions, according to the same Cornerstone Advisors survey, include growing commercial loans, expanding their digital presence among online and mobile channels, and growing consumer deposits. And banks are privy to the fact that fintech can help in these areas. When it comes to determining the areas that banks and credit unions plan to focus their fintech efforts, an overwhelming 93 percent of bankers reported that a lending and credit product focus was important for their collaboration, and 96 percent reported digital account opening was at the top of their list.

So how, exactly are financial institutions leveraging fintech to solve these priorities and restore optimism? Let’s take a look.