Community bankers are largely positive about the future, based on the first results of a new index gauging business sentiment among the financial professionals who serve a critical role in local economies.

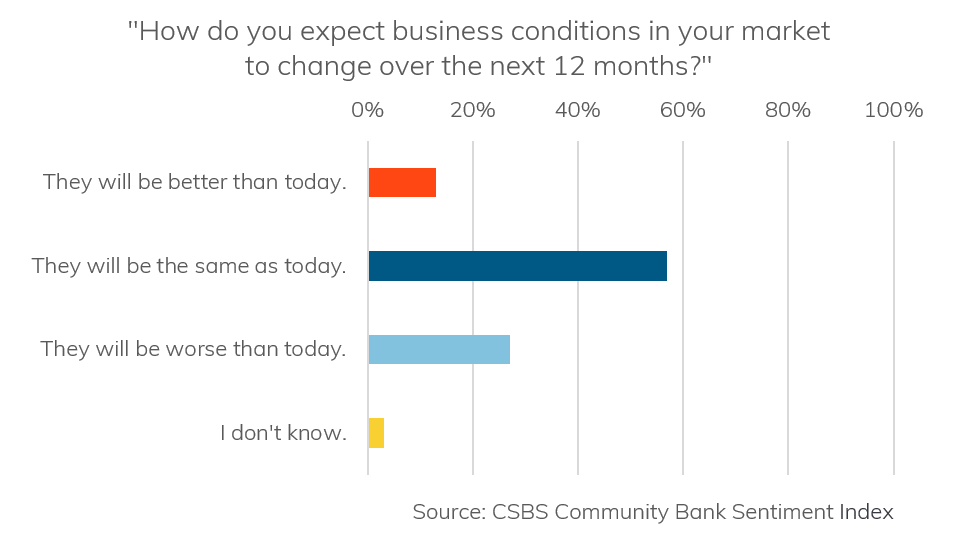

More than two-thirds of community banks surveyed for the Conference of State Bank Supervisors (CSBS) Community Bank Sentiment Index indicated they expect business conditions will be the same or better in the next 12 months.

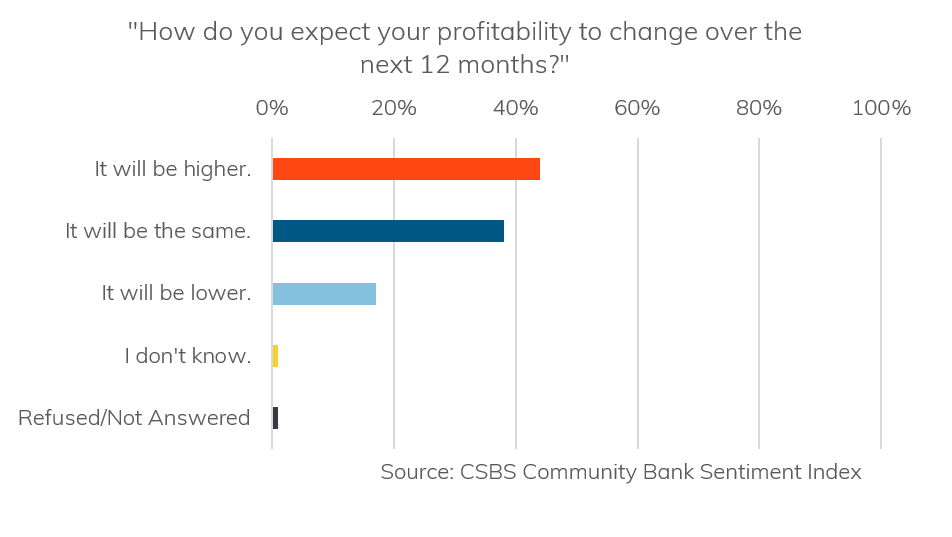

“Given the overall positive state of the economy, this is pretty remarkable,” Michael L. Stevens, CSBS Senior Executive Vice President, said in the conference’s newsletter announcing the results. “As you would expect, a positive economic environment has a direct correlation to the bottom line, with 80% of banks expecting the same or better profits and 60% believing they will see an increase in franchise value.”

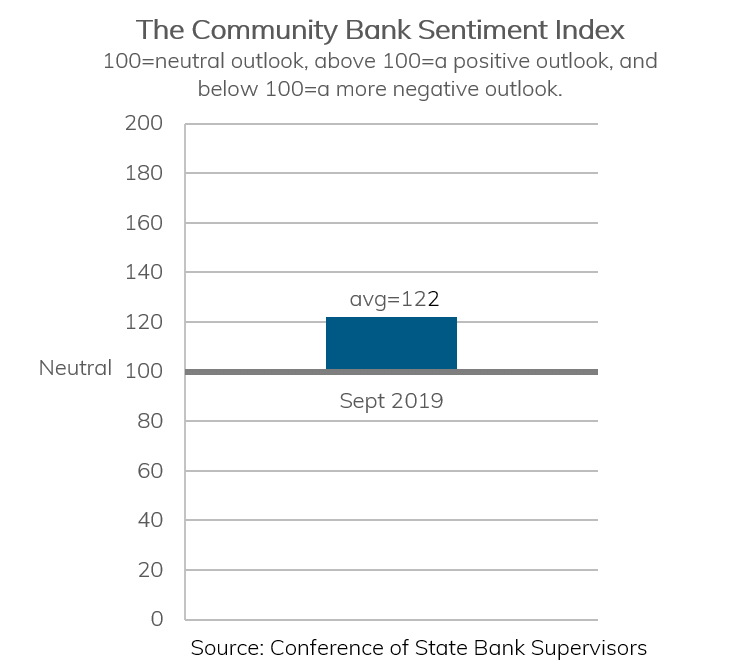

Overall, the current average value of the Community Bank Sentiment Index is 122, indicating more positive than negative responses to seven mostly forward-looking questions that bankers will be asked each quarter to construct the index. An index of 100 would mean bankers’ outlook is neutral and anything below 100 would indicate a negative outlook.

“Banks are central to the effective performance of the business sector,” said Temple University economists William C. Dunkelberg and Jonathan A. Scott, who worked with CSBS to create the index, in a paper summarizing the first results of the index. Dunkleberg is the former dean of Temple’s School of Business and Management and has served as the Chief Economist for the National Federation of Independent Business since 1971.

“Bankers’ attitudes reflect conditions in capital markets and conditions in the economy, primarily the local economy served by each bank,” Dunkelberg and Scott wrote. “These insights have the potential to inform the market and policy makers on the overall health of the economy, opportunities, and risk.”