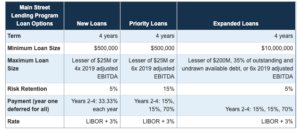

The Main Street Lending Program has opened for lender registration. To learn more about MSLP updates, click here. To receive updated information on any new round of PPP funding and how lenders can participate, subscribe to our newsletter.While community financial institutions have been focused on the Small Business Administration’s Paycheck Protection Program (PPP), the Federal Reserve recently unveiled a new loan-purchase program, the Main Street Lending Program (MSLP). Under the Main Street Lending Program, the Fed has pledged $600 billion to help middle-market businesses weather the economic shock caused by the coronavirus pandemic. The MSLP establishes three loan facilities, the Main Street New Loan Facility (MSNLF), the Main Street Expanded Loan Facility (MSELF), and the Main Street Priority Loan Facility (MSPLF). Like the PPP, the MSLP seeks to support the economy by providing economic relief to local businesses across the country. An average of two-thirds of every dollar spent at local businesses stays in the community, according to the Small Business Economic Impact Study by American Express. Also, as with the Paycheck Protection Program, community financial institutions will play a vital role in the Main Street Lending Program. Eligible lenders for the MSLP include U.S. insured depository institutions, U.S. bank holding companies, and U.S. savings and loan holding companies. However, whereas the PPP applied solely to small enterprises, the MSLP expands aid to mid-sized businesses. The Fed program allows eligible lenders to originate new loans or increase the size of existing loans to businesses with up to 15,000 employees or $5 billion in 2019 annual revenues. There is no minimum number of employees, so smaller borrowers can take advantage of both the MSLP and the PPP. However, the minimum loan size for the MSNLF and MSPLF is $500,000 and $10 million for MSELF loans.

Main Street Lending Program Offers Loan-Purchase Option to Lenders Helping Businesses

April 15, 2020

Read Time: 0 min

About the Author