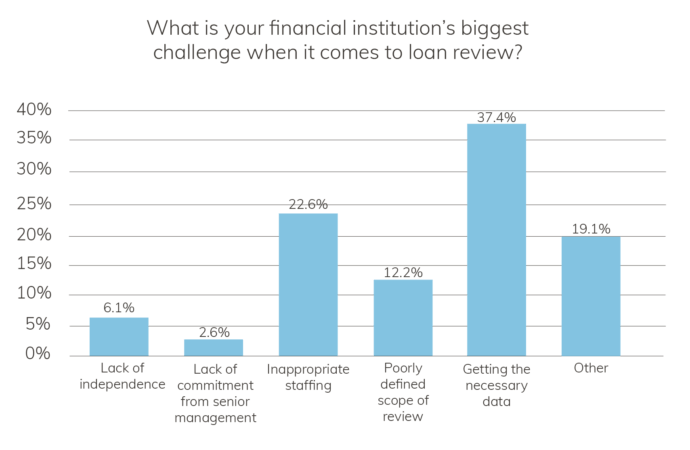

Staffing concerns and getting the necessary data are financial institutions’ biggest challenges when it comes to performing loan reviews, according to a new survey by Abrigo.

Among 115 people from banks, credit unions, and other organizations surveyed about the loan review function, 37% named getting the necessary data as the top challenge.