Credit analytics – Credit migration

Credit analytics – Credit migration

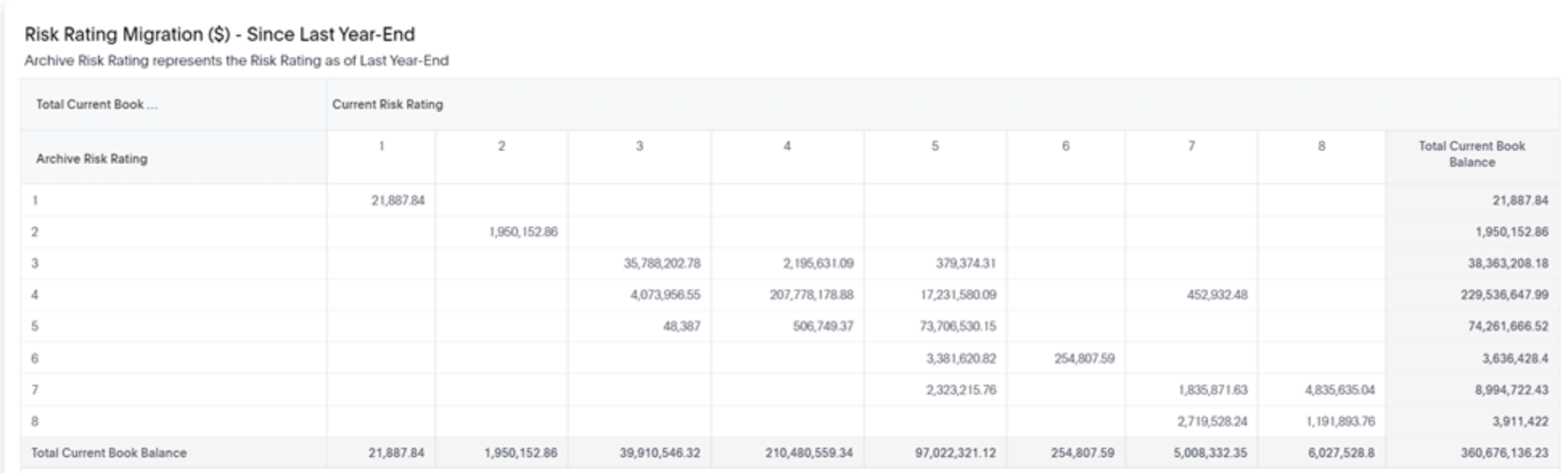

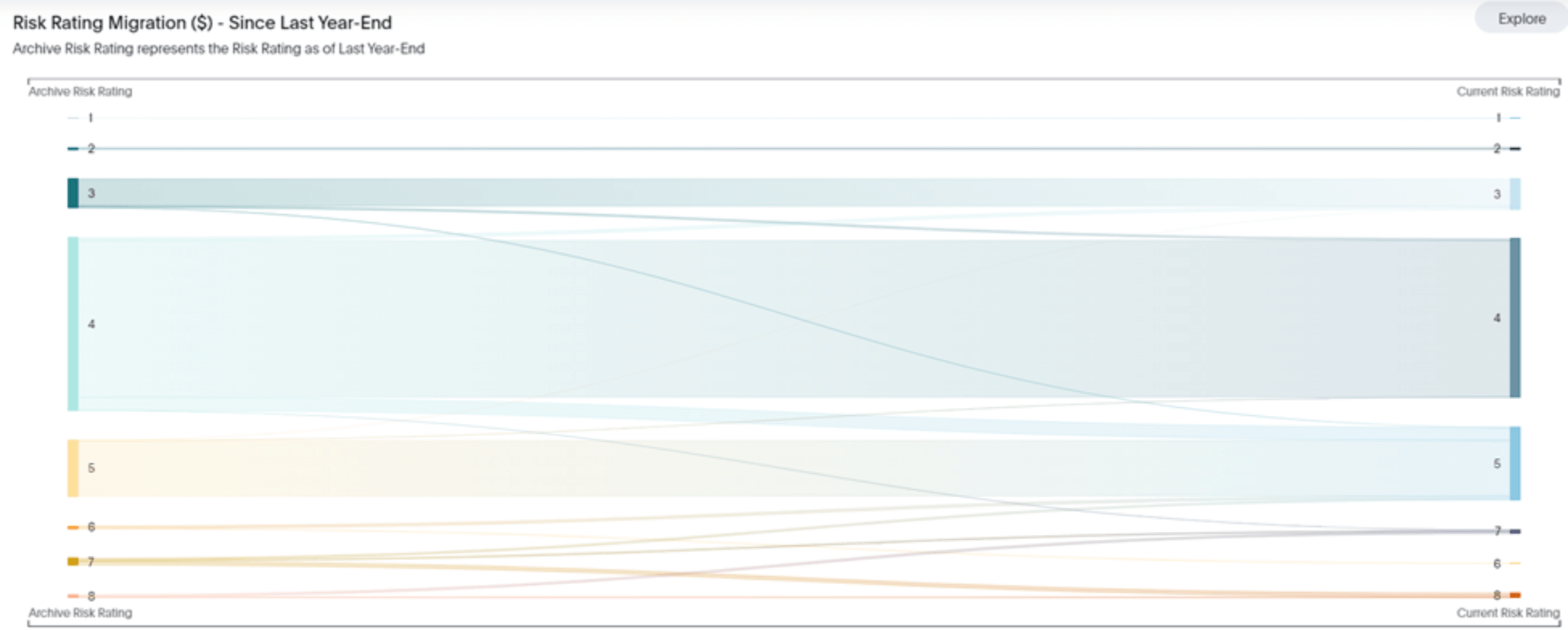

Trending migrations within a credit risk indicator can help an institution identify if the portfolio or a certain market or product is starting to trend in a riskier direction. It provides a glimpse of portfolio credit health and can aid credit monitoring.

When we say migration, we mean isolating a credit risk indicator of loans as of a point in history (last month-end, quarter-end, year-end, 12 months ago, etc.) and then observing where the balance or count of loans have moved in terms of the credit risk indicator.

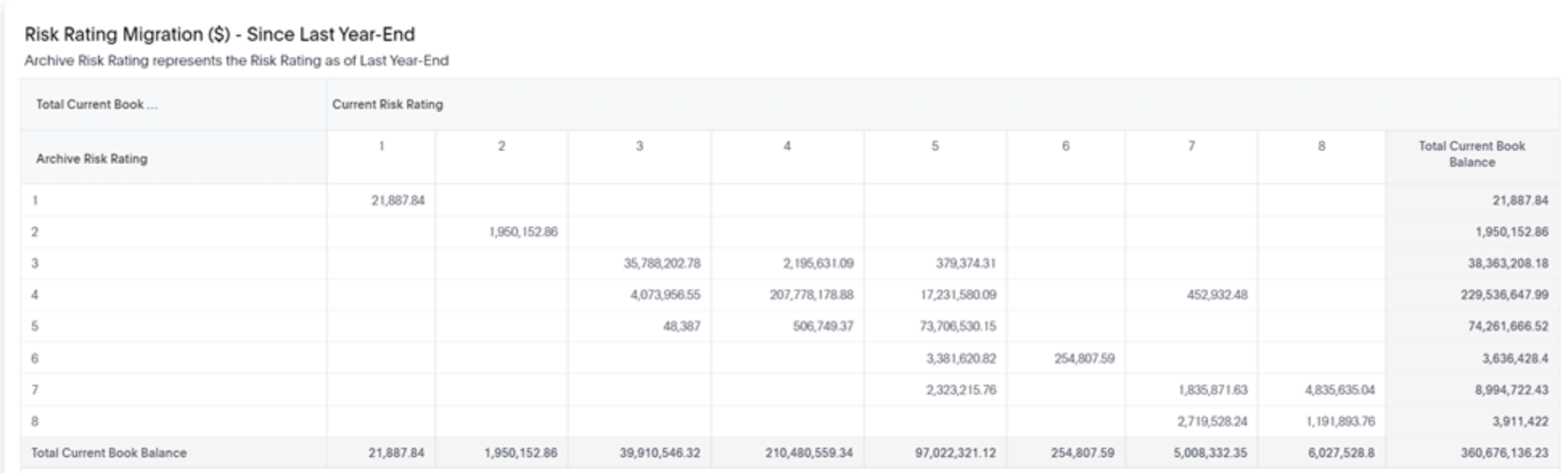

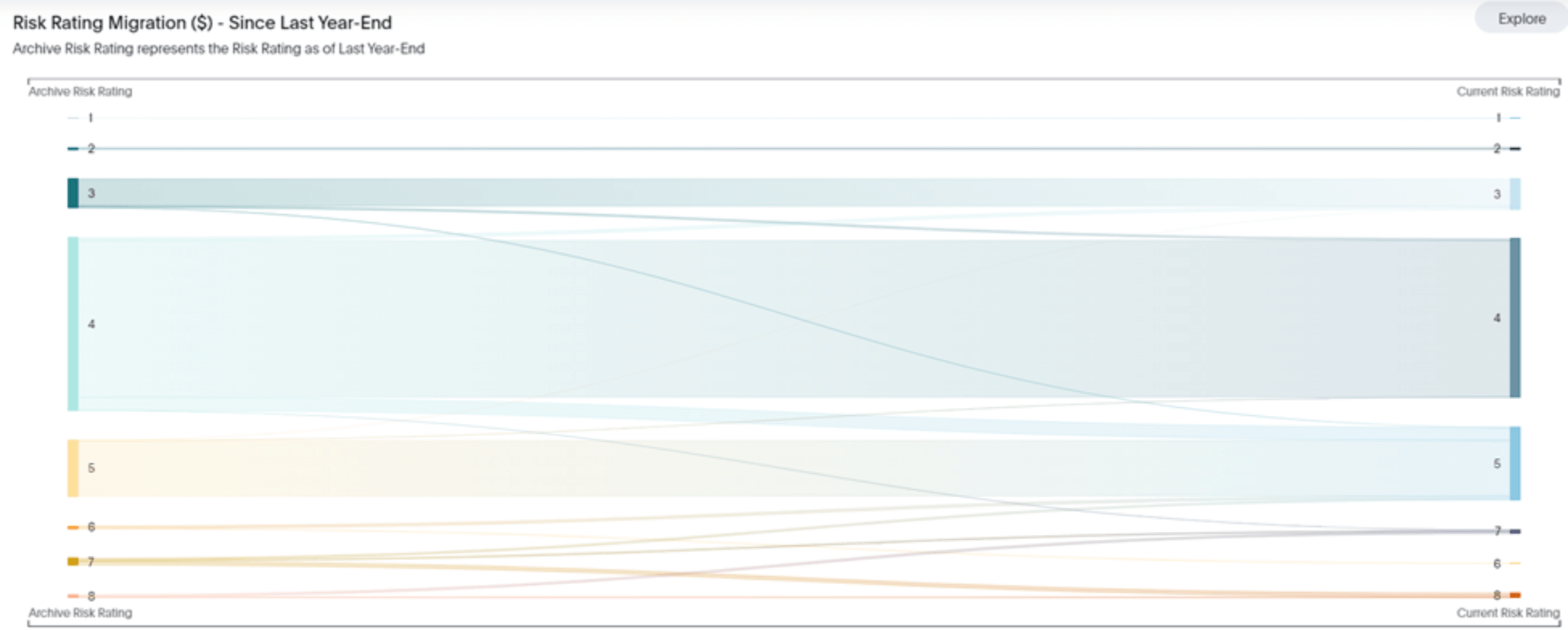

Below is an example of a risk rating migration that observes migration of balances as of last year-end (“Archive Risk Rating”) to current (“Current Risk Rating”). The migration is shown as absolute balances and as a percent of the risk rating in the charts below. A visual to help conceptualize the migration is also shown.

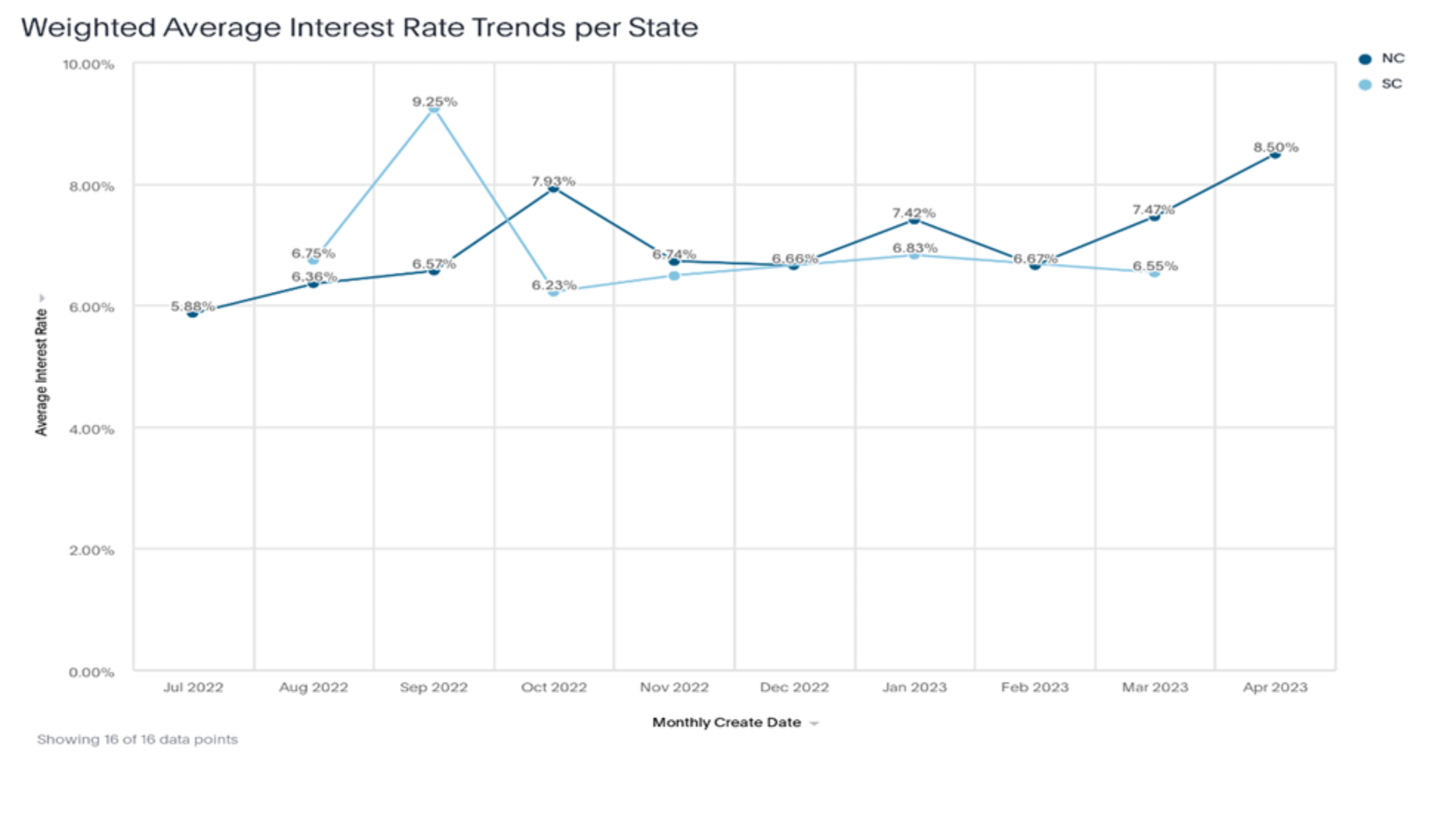

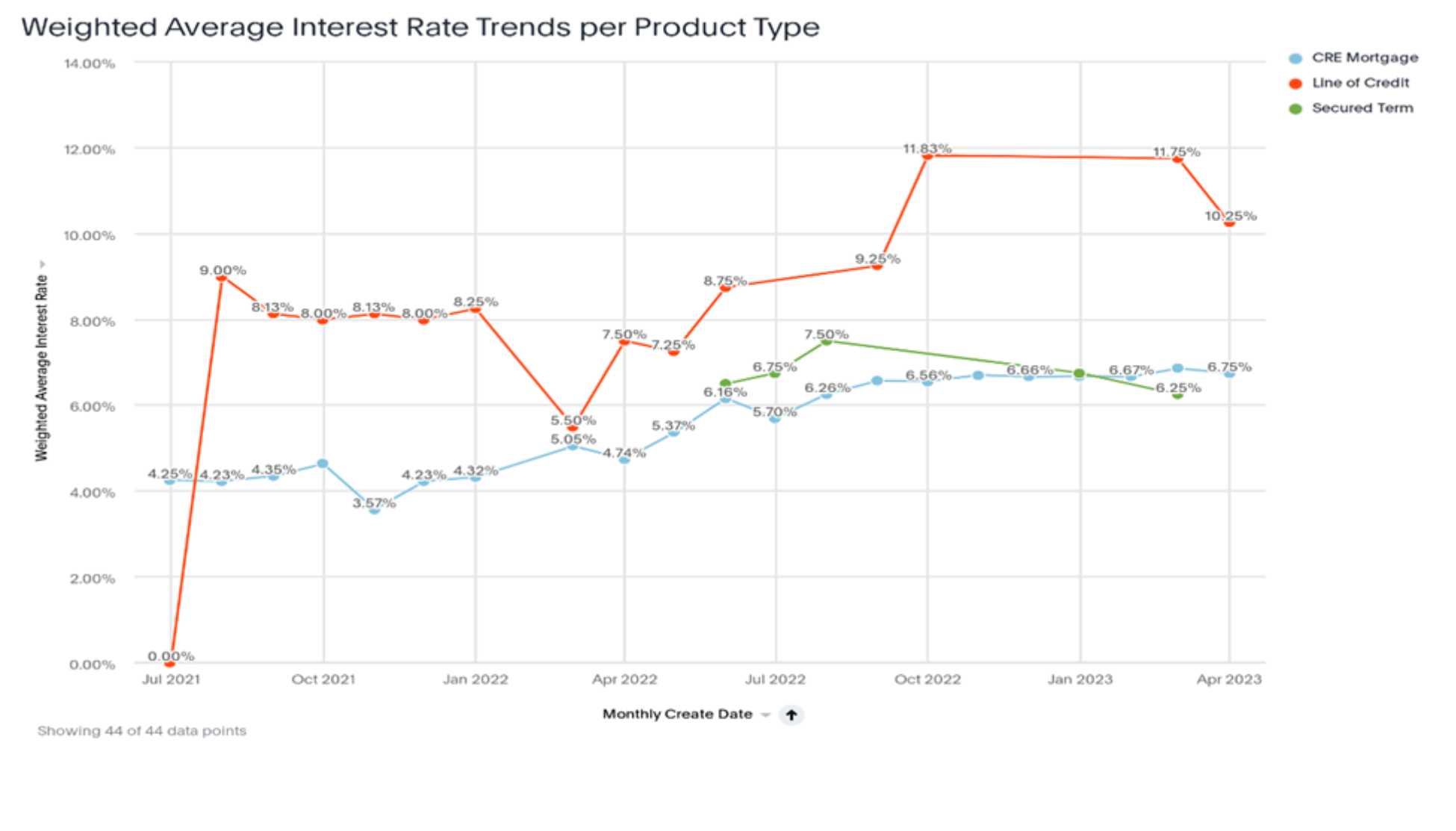

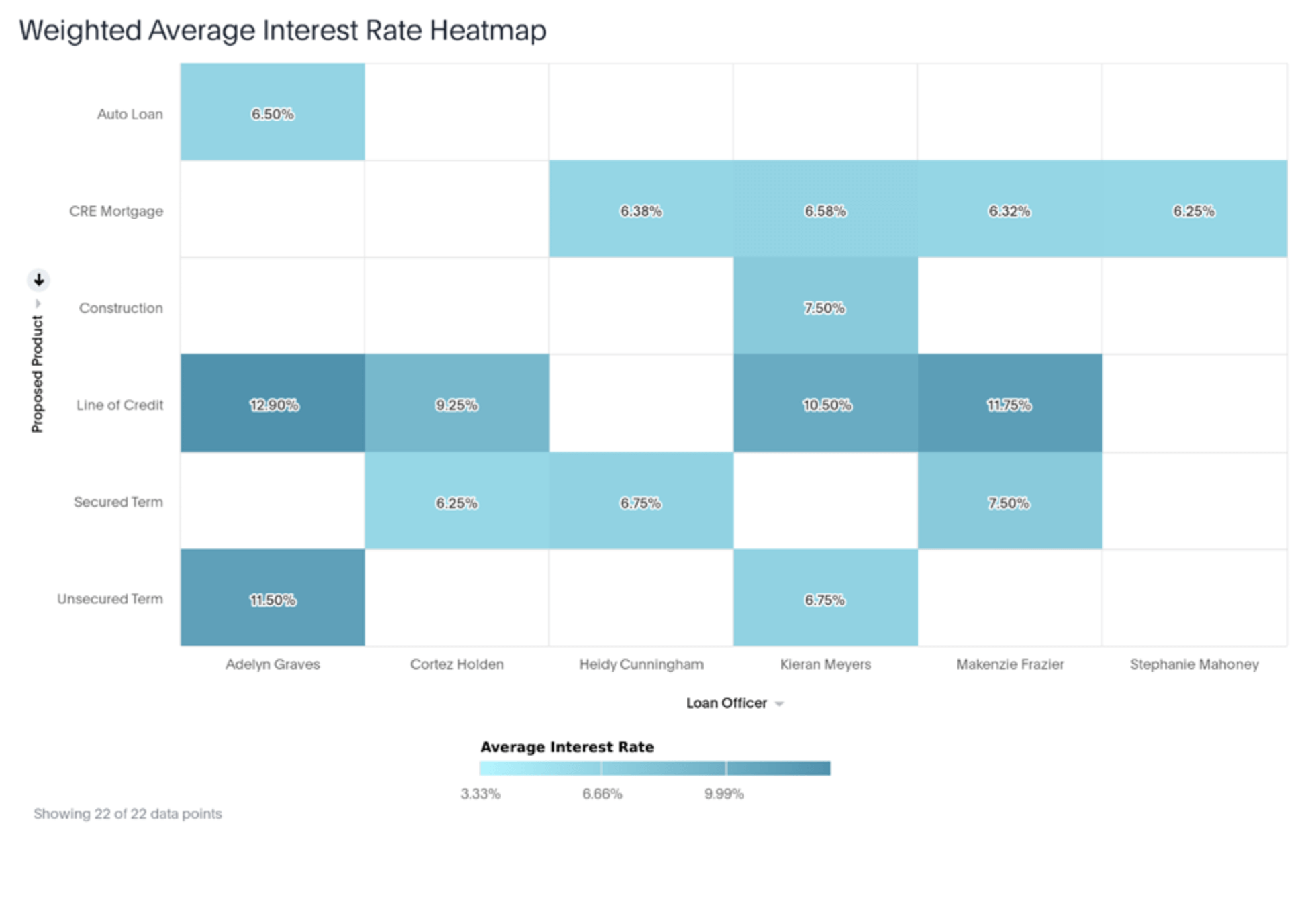

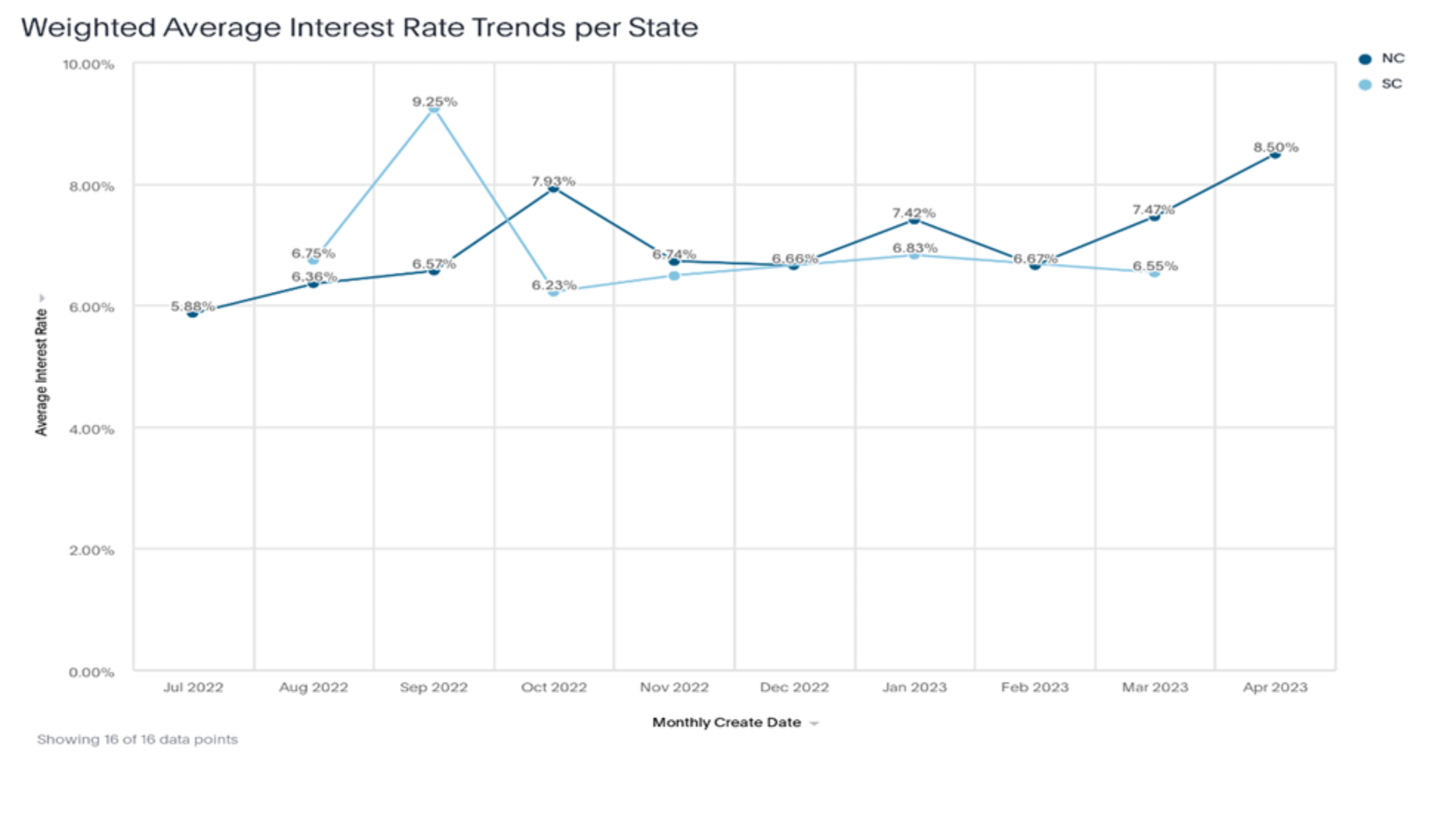

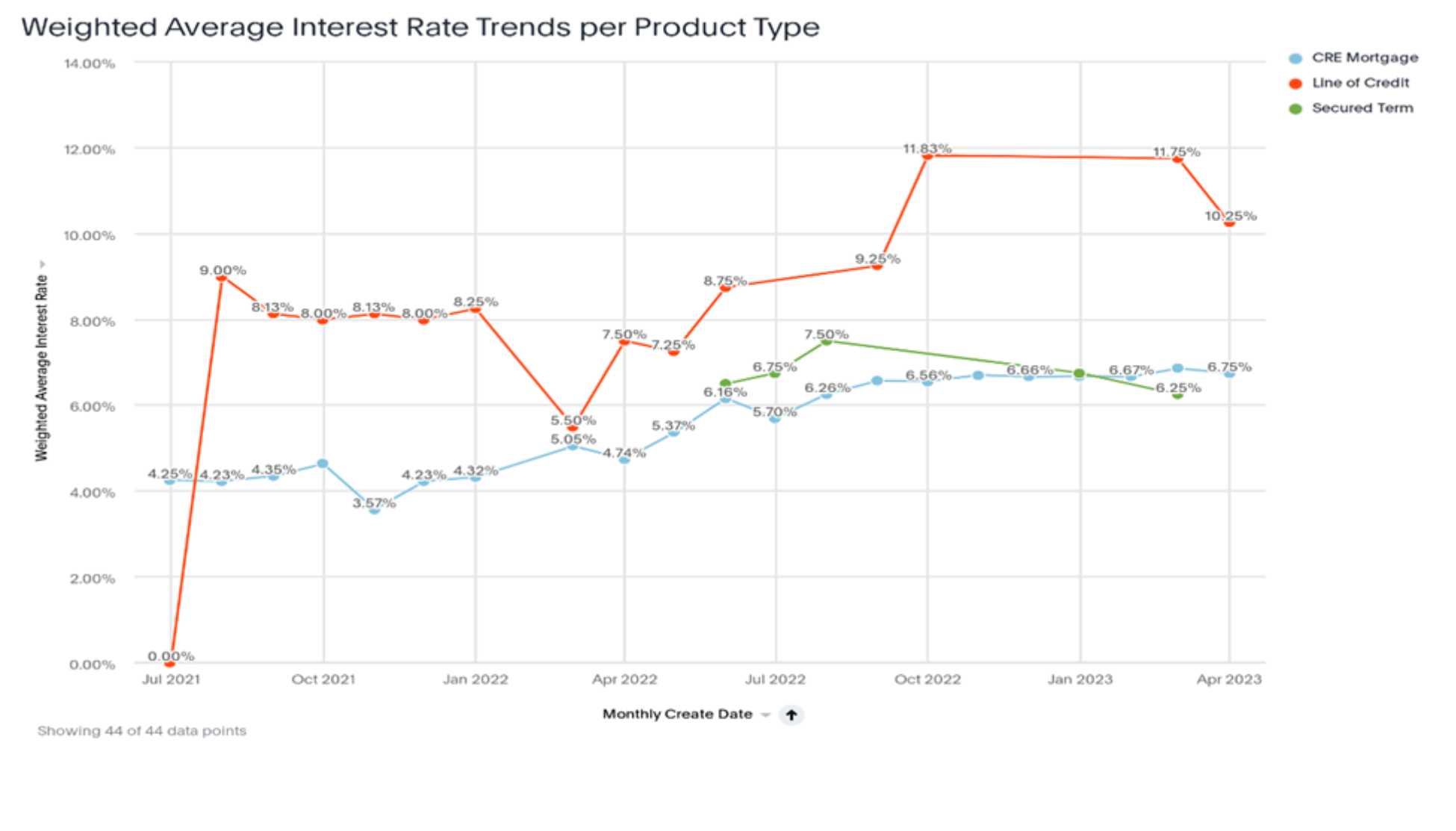

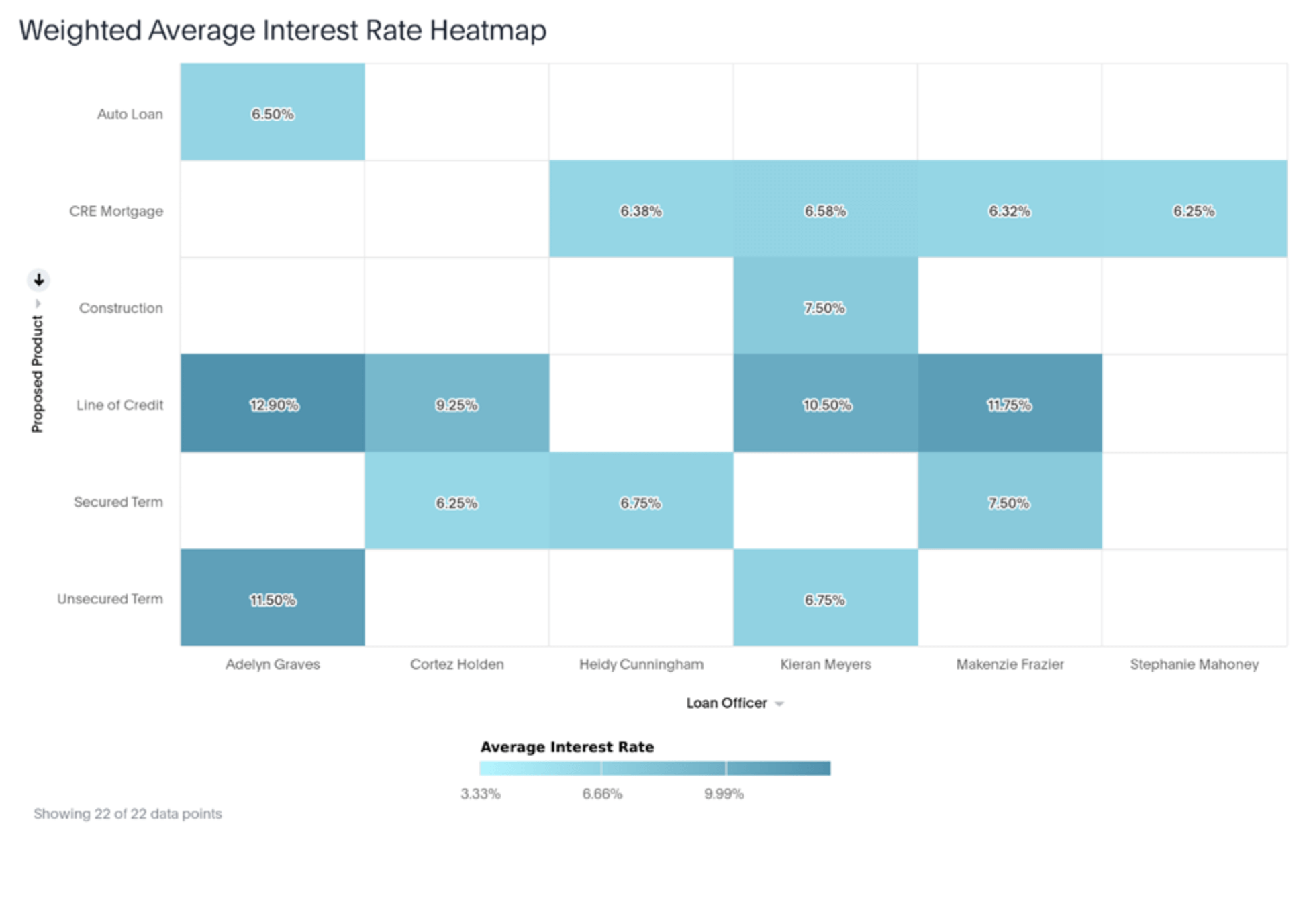

Pipeline analytics – Interest rates

With the rising interest rate environment, it’s as important as ever to generate higher rates on loans to offset margin compression on higher-cost deposits. Reports below show the trending weighted average interest rates on products, within markets (such as state, MSA, etc.), and by loan officer. This type of credit dashboard can help ensure the institution is generating the returns they’re expecting.

Additionally, keeping tabs on the rates for loans currently in the pipeline can help ensure the institution is generating the returns it’s seeking. Tracking rates for these loans could help identify a trend of price concessions that may be emerging.

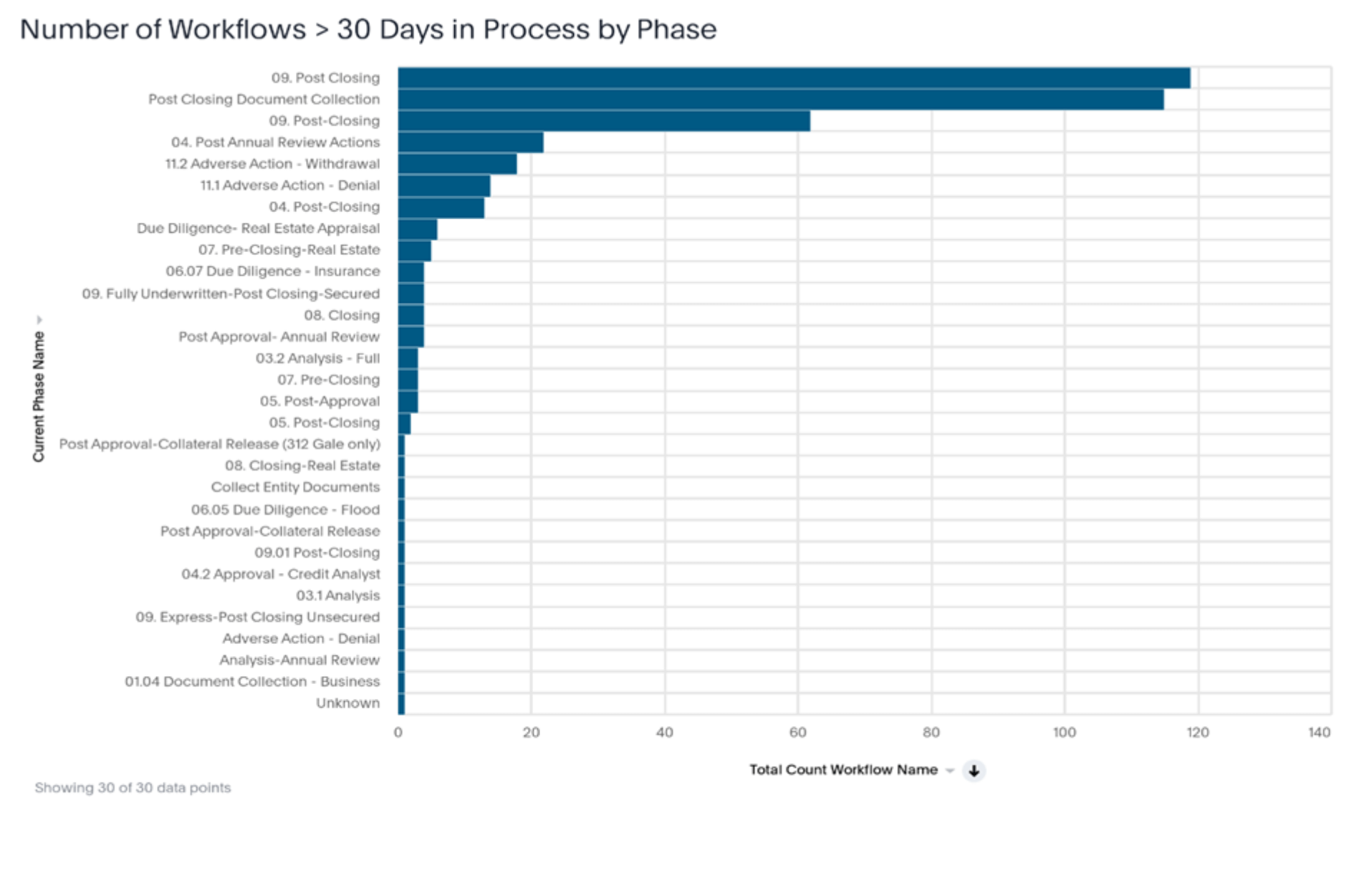

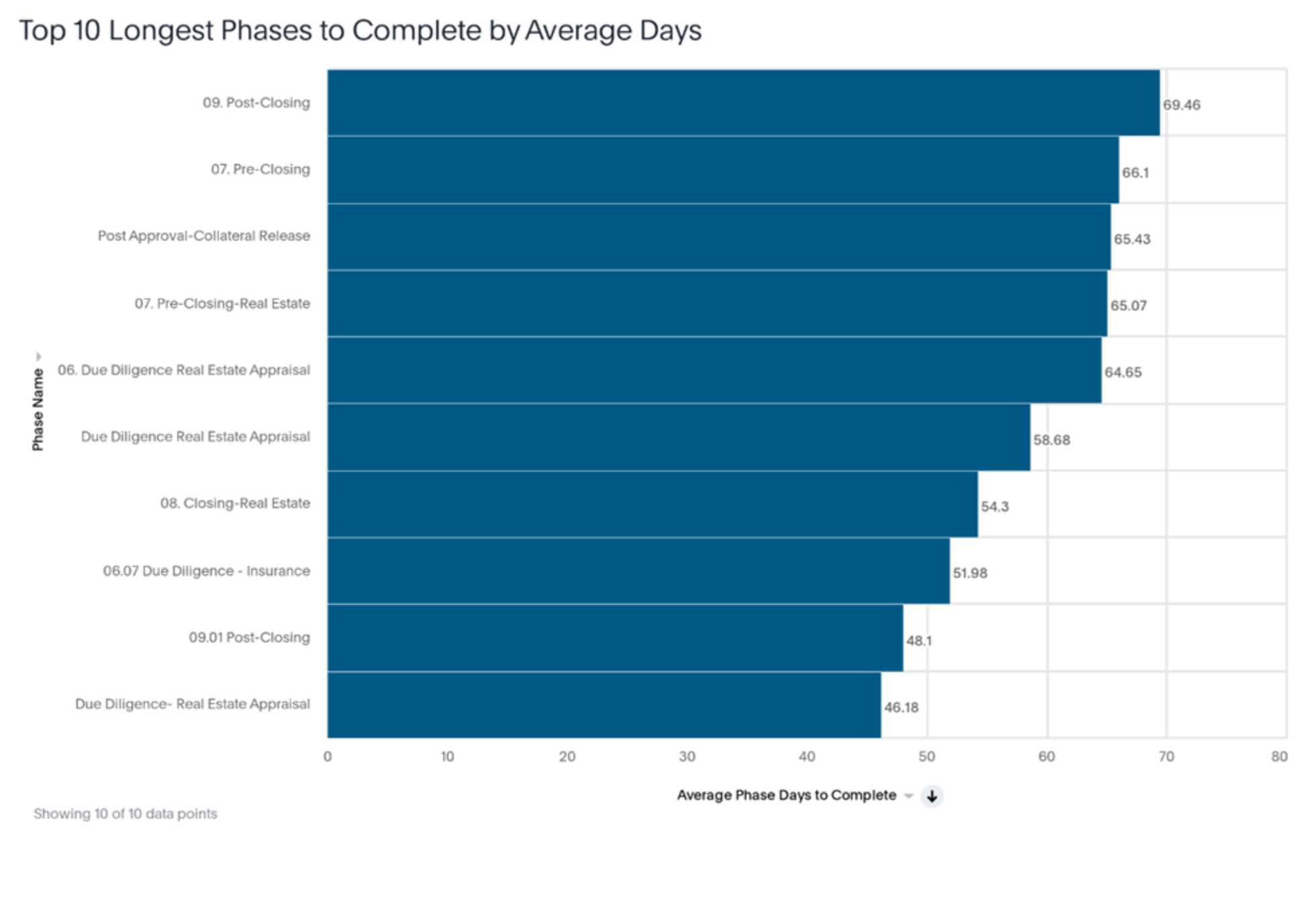

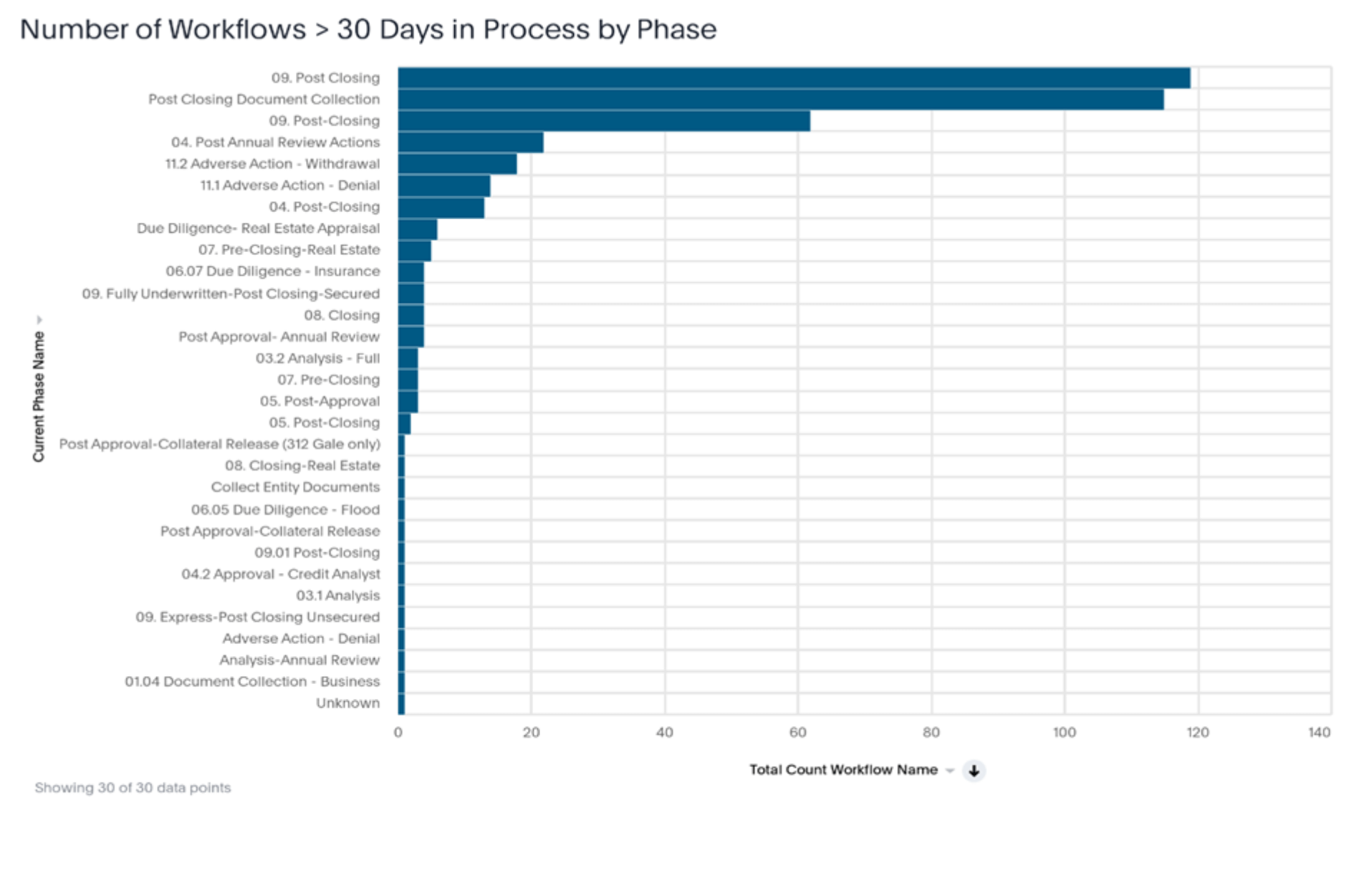

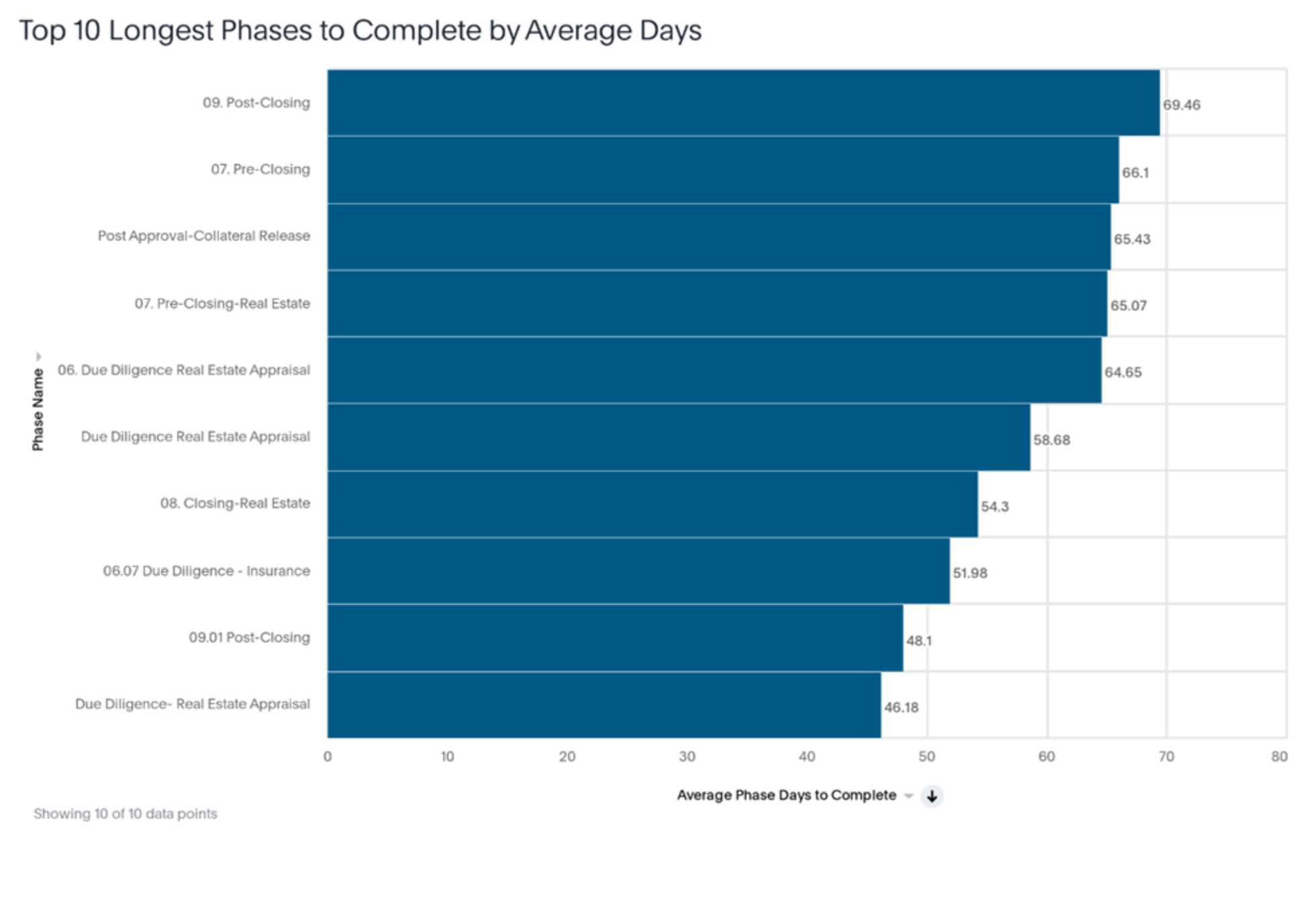

Workflow reports – Bottlenecks

Workflow reports – Bottlenecks

Community financial institutions are acutely aware of their advantages and disadvantages relative to the large banks across the country. One of community institutions’ primary advantages is their ability to provide personalized and targeted customer service. Quick and efficient turnaround is paramount to maintaining this advantage, so leaders need insights on bottlenecks in the process as well as current workflows that may be stuck.

The charts below show the volumes for specific workflows and which actions are taking the longest time. These insights can help leaders determine what is or is not working well in the current loan origination workflow and whether any specific areas need additional attention.

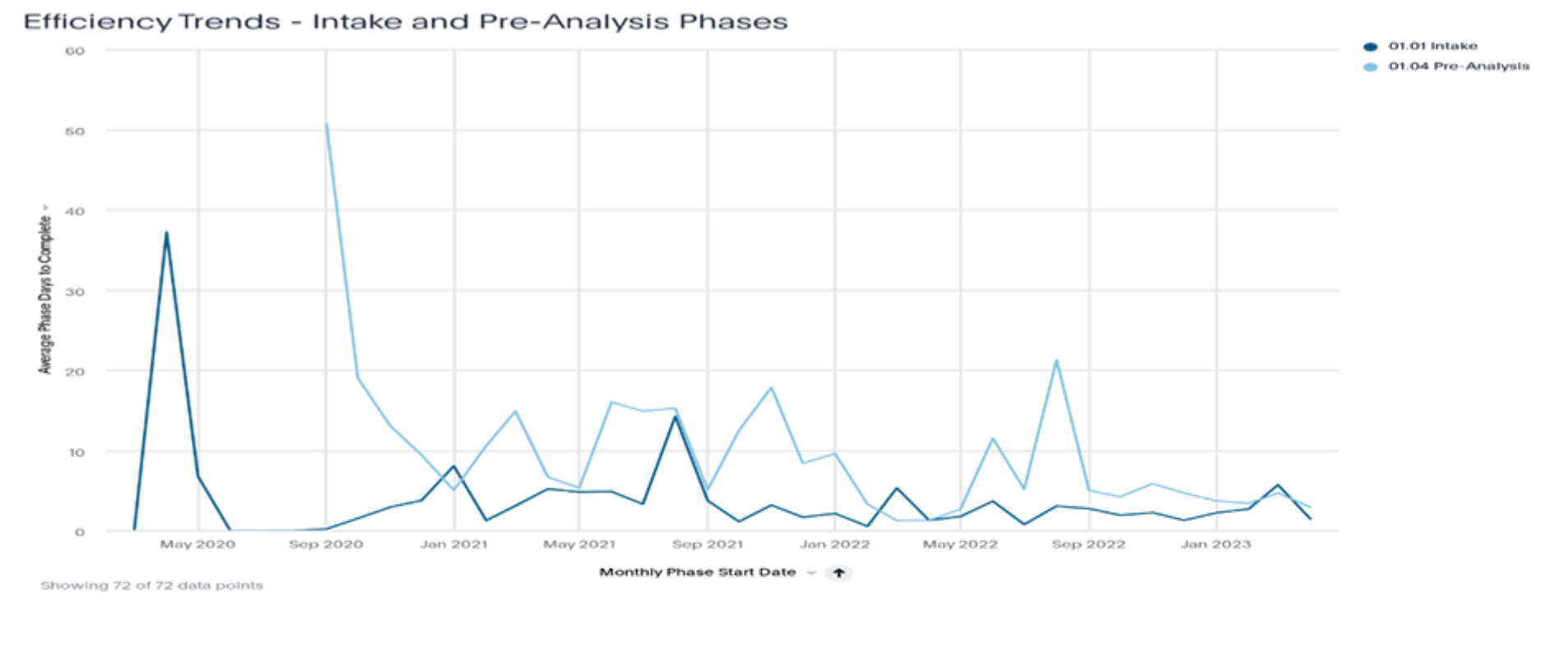

Workflow reports – Efficiency trends

Workflow reports – Efficiency trends

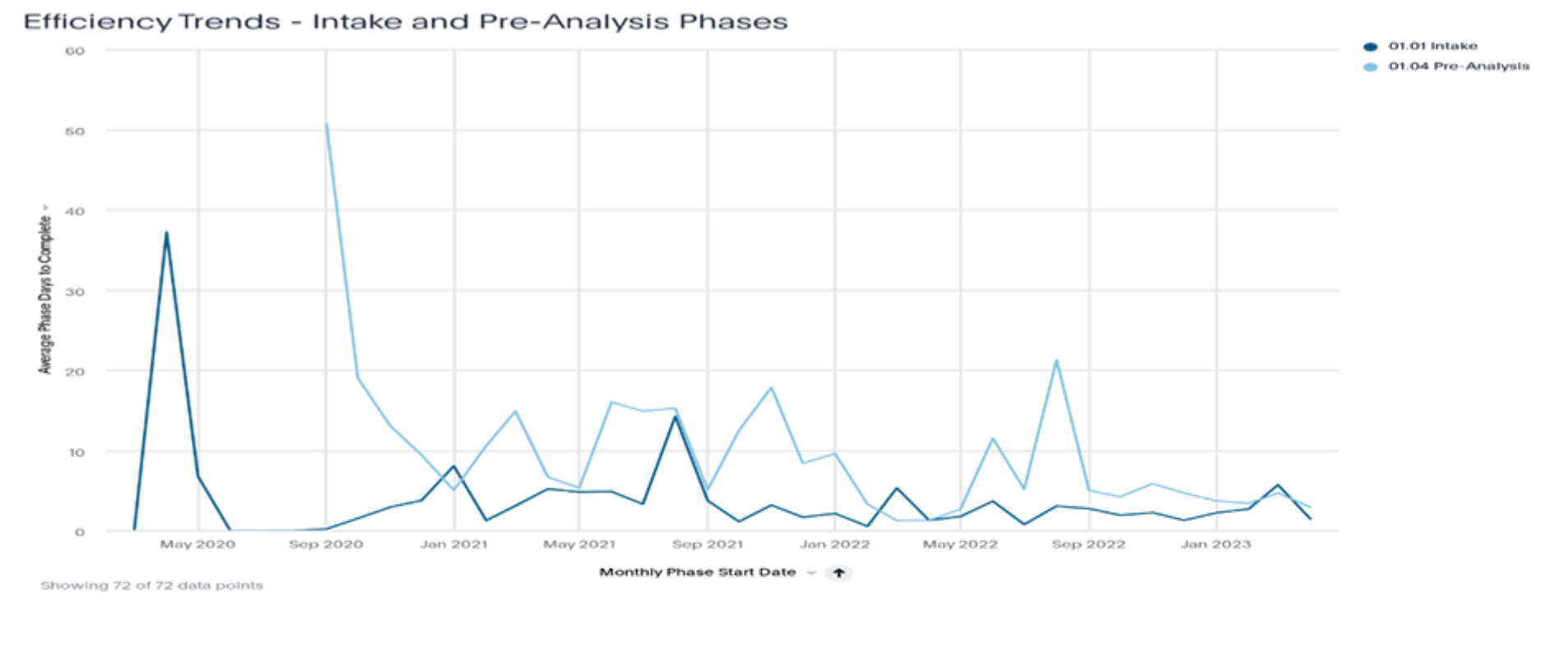

The above visuals are beneficial in determining the current state of an institution’s workflow/process. But it’s also important to track whether the institution is improving in its process over time or whether the process has slowed due to growth, recent volume, or other reasons.

Dashboards isolating key phases or steps in the workflow and tracking efficiency trends can identify whether the institution may need to explore options for more resources or partnering with a vendor to help improve process performance. The charts below are examples of ways to track the efficiency of the intake and pre-analysis phases of loan decisions using monthly trends.

Workflow reports – User efficiency

Workflow reports – User efficiency

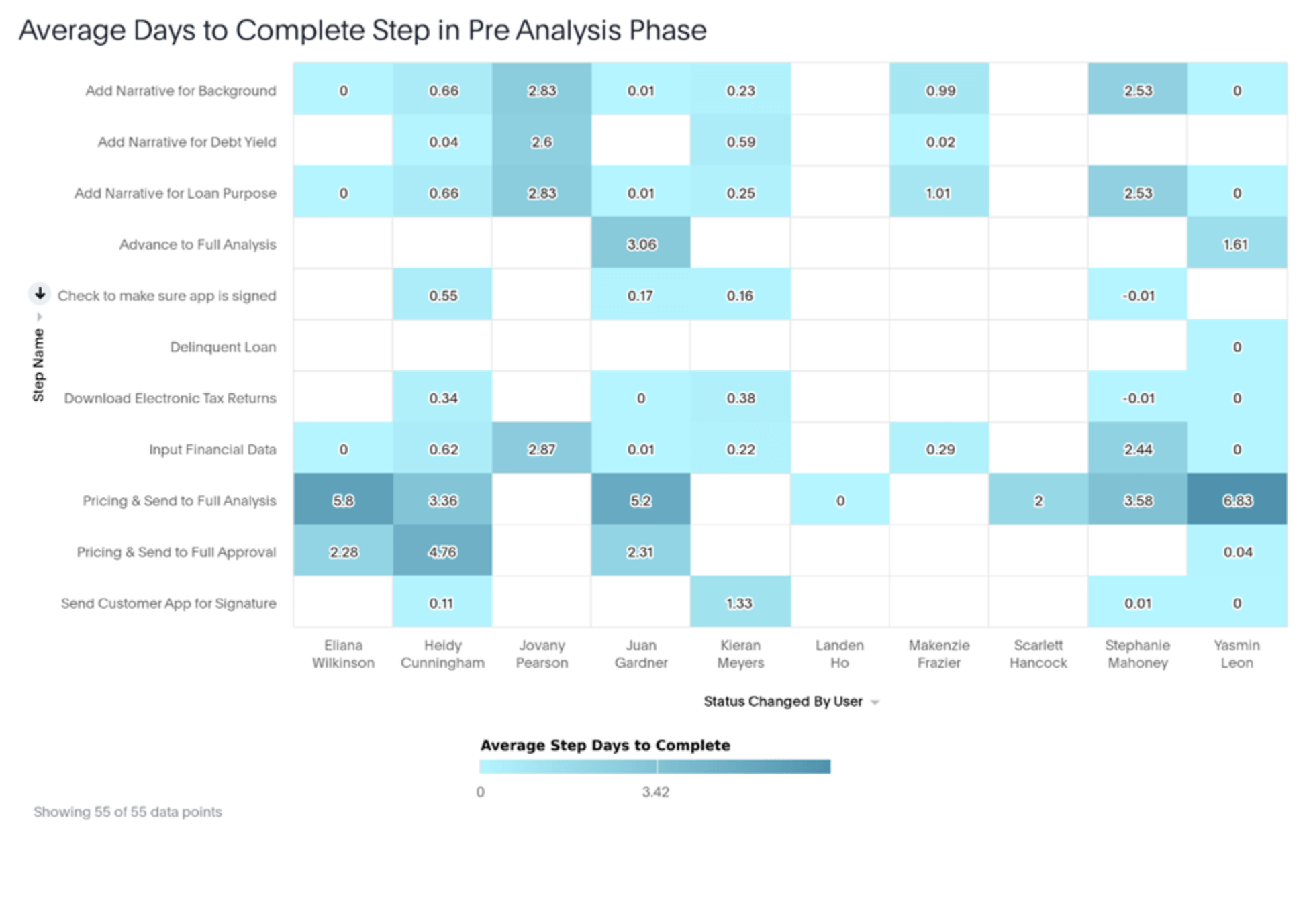

Processes are good and necessary. But any financial institution — any business really — knows that the execution of those processes is determined by the people behind them.

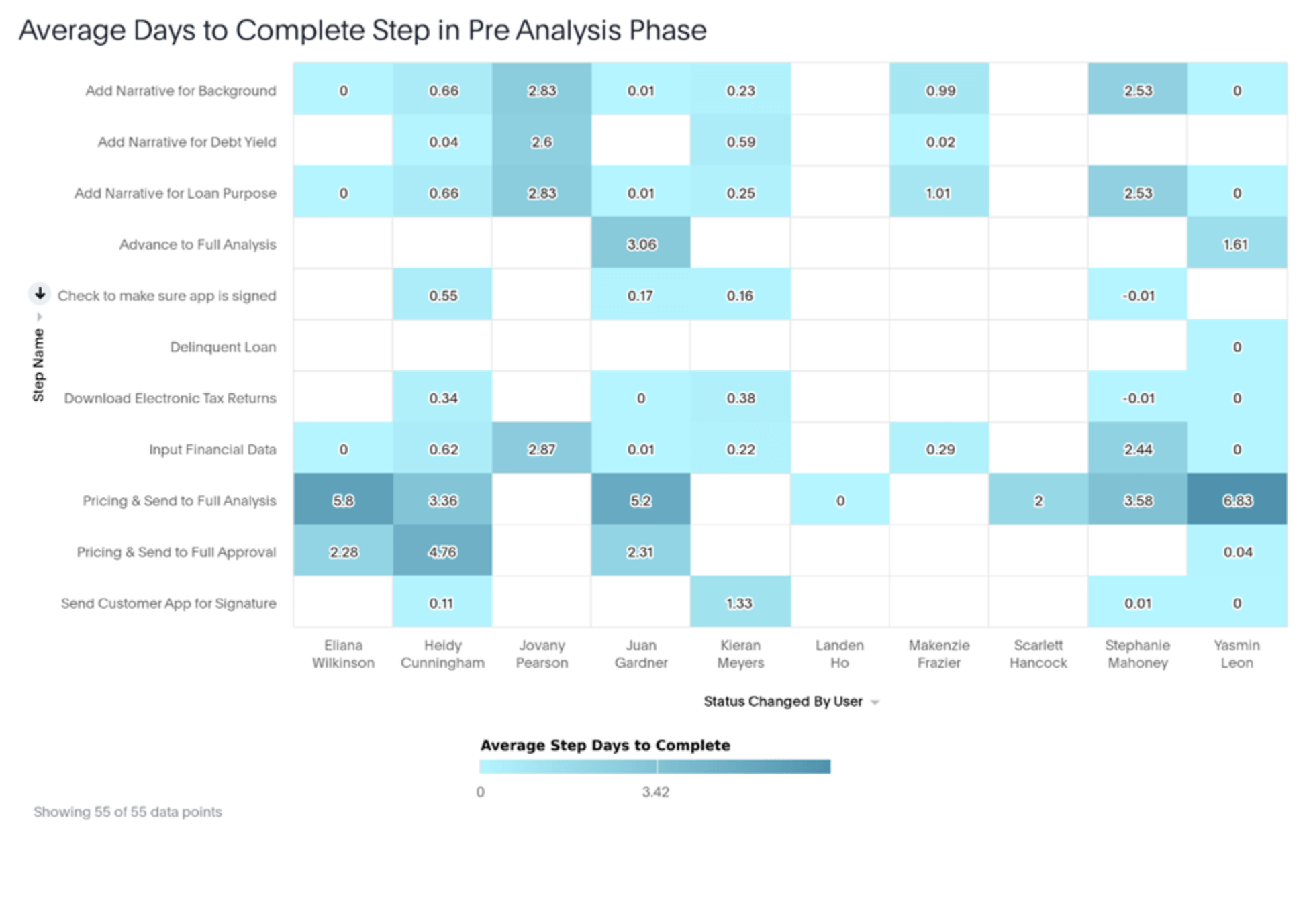

Banks and credit unions that can break down and determine the efficiencies of their teams and individuals are better able to highlight areas where a team needs more assistance. Performance dashboards can help them more quickly identify whether a particular individual could benefit from additional training or best practices.

Dashboards that isolate key phases of lending and credit and break down steps by employee may highlight those needs across the institution. The chart below shows at a glance how long each team member takes to complete various steps, highlighting those who are working more efficiently and those who are less efficient.