Take a deeper dive into deposit pricing.

Take a deeper dive into deposit pricing.

As outlined above, the cost of funds (interest expense) that financial institutions incur can become challenging during rising rate environments. This can become even more of an issue if leadership and the Asset Liability Committee (ALCO) are unable to make informed strategic decisions due to being unaware of the sources and reliability of their funding. Reacting to the market without a strategy can be one of the most common mistakes financial institutions can make during a rapidly changing environment.

A core deposit analysis can arm decision-makers with confidence moving forward, knowing they have detailed information and data backing their next moves. Having data related to depositor demographics and behaviors, along with key competitor movements, is vital to staying afloat through rising rates. Pricing deposits at a level that allows financial institutions to retain or attract customers is of utmost importance. If you cannot retain or attract any depositors, it will force a borrowing position, which in turn will likely lead to increased interest expense and lower margins.

Making use of a core deposit study can be one of the most important tools a financial institution can employ during a rising rate environment so they can learn more about their core funding sources and how to best implement a strategy to increase interest margins. Oftentimes, banks and credit unions get caught up in narrowly focusing on the pricing of their assets and place less of an emphasis on their liabilities. Betas, lags, and decays are all key assumptions for any ALM model. Failing to have a thorough deposit study performed that provides those assumptions could be leaving dollars on the table for the institution and its stakeholders. These key assumptions are formulated using historical consumer behavior. If the last time a study was performed was three years ago, the assumptions are not only outdated, but they also could be steering management in the wrong direction in strategic planning.

An accurate core deposit analysis allows management to learn a great deal about their core funding and, in turn, how to effectively make and implement decisions surrounding that funding.

Regularly update the ALM model.

Regularly update the ALM model.

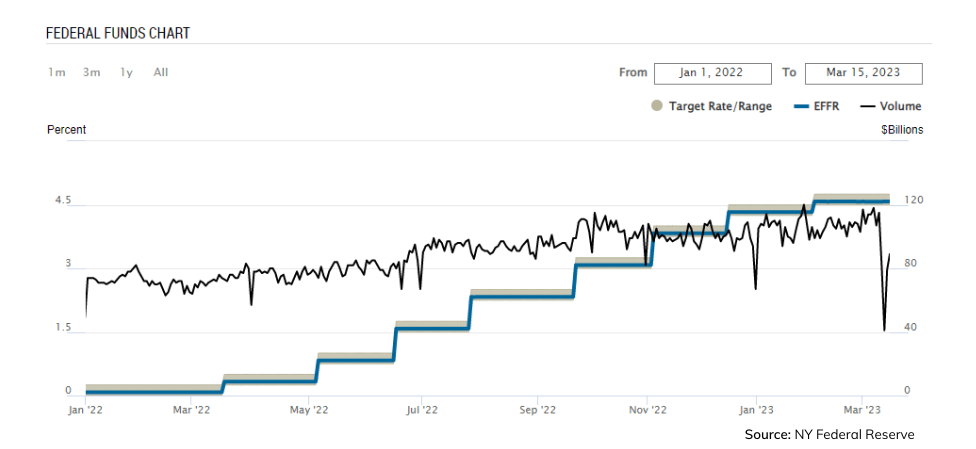

Sometimes, especially given the current economic climate, a quarterly update to an institution’s offered rates on loans and deposits, coupled with new assumptions and inputs, will not provide the outlook needed to effectively manage interest rate risk and institute measures to protect the best interests of the bank or credit union. Conditions are changing, and they have been changing rapidly. The Federal Reserve has hiked rates by an additional 150 basis points since the increase in September 2022. Given the latest rate hike was only 25 bps (compared to the prior five being 50-75 bps each), the Fed may be slowing down the pace. However, it’s difficult to believe that financial institutions will see any sort of pivot from increasing the fed funds rate from where it is now.

Keeping inputs and key assumptions updated regularly provides management and the board with the best reporting by which they can develop a clearer path to success.

Maintaining the status quo on assumptions when the economic environment is so dynamic could lead to lost opportunities if management is not continually informed on the forecasted spread between interest income and expense.

During all the current uncertainty, there is another point to consider. Is your current ALM model robust enough and sufficient to execute the inputs and assumptions that you’d like to see in order to feel comfortable with the data then presented to you? Are there key elements missing in the model that could have a material impact on forecasting income and expenses for the upcoming month, quarter, and year(s) ahead?

The output of a model can only be as accurate and precise as the model will allow it to be. The one “behind the wheel” also needs to be comfortable with the model to be able to make confident inputs and assumptions. ALM consultants can assess the adequacy of the financial institution’s ALM model and inputs or assist with assumptions and reporting to provide added confidence in decisions.

Have an ALM model validation completed with the goal of strategic gains.

Have an ALM model validation completed with the goal of strategic gains.

There are typically two schools of thought around regulatory compliance among financial institutions and their leaders. One is a view of compliance as seemingly unnecessary, burdensome, and an additional task added to an already full plate. The other is as an opportunity to improve upon policies, procedures, tools, and the like, which can benefit both the institution and shareholders. Having an ALM model validation completed for the sake of the institution’s performance rather than for regulatory compliance will likely create greater benefits due to the goals for which the validation is undertaken.

When a bank or credit union is looking for a model validation to be performed by an external third party for the sake of regulatory compliance, there can be a collective sense of “checking off the box.” Going with the lowest bidder oftentimes brings lackluster results, improvements, and suggestions. Having a third party do a thorough validation of the ALM model with an intention of making improvements allows teams to dig further into inputs and assumptions, gather advice on how to better implement changes, and likely shift the ROI from “checking off the box” to providing management and ALCO useful, pertinent information.

Consider the impacts of loan pricing models and loan portfolio composition.

Consider the impacts of loan pricing models and loan portfolio composition.

With interest rates rising, loan demand is beginning to slow. While loan pricing will often get more attention than deposits, if left alone for too long, it could leave the financial institution with two suboptimal outcomes: missing out on valuable customers or lending at rates that do not align with the risk being taken on. A key take-home point here: Are you being compensated for the risk that is presented when lending out money to borrowers? Is the reward worth the risk?

Institutions using a loan pricing model can effectively manage and regularly update their loan pricing so they can keep up with economic conditions such as the current ones. Factors such as credit quality, changes in risk appetite, increased competition for credit, and changes in cost (among other things) can lead to a much different pricing decision on a loan than even just a month or days prior. Loan demand may be trending downward, but pricing loans strategically and effectively becomes even more important to attract quality customers and meet profitability goals.

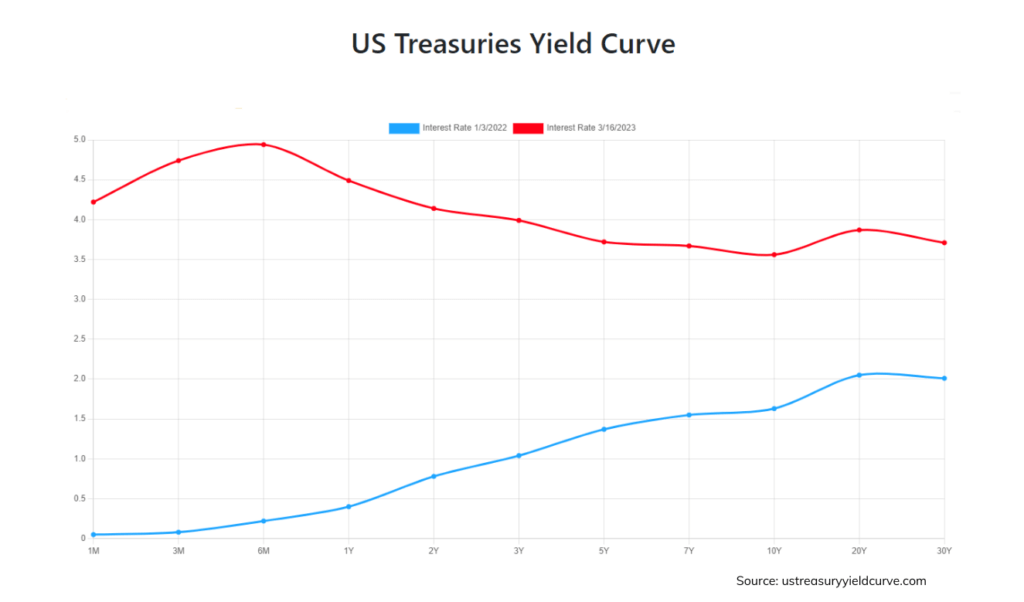

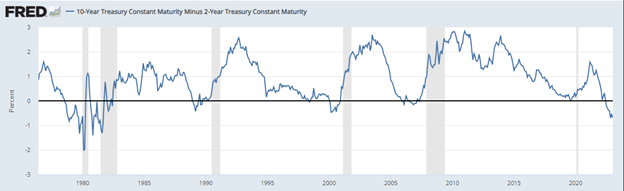

Another related consideration is that liability-sensitive banks and credit unions – meaning that their liabilities reprice more frequently than their assets – are at increased risk during times of rising interest rates. When a large majority of financial institutions’ balance sheets are composed of fixed-rate loans rather than variable-rate loans, it leads to a narrowing spread between interest income and expense. This is especially so when the Treasury curve has inverted.

Take, for example, Bank “A” with a loan portfolio composition of 50% fixed and 50% variable rate versus Bank “B” with a 40% fixed rate and 60% variable rate. As rates increase, Bank “A” will be at a disadvantage because half of its portfolio will be fixed at lower rates, leading to decreases in potential earnings and a decrease in economic value of the loan. On the other hand, having a portfolio in which 60% of loans can reprice as rates increase helps Bank “B” hedge against potential losses and combats the increase in rising funding costs. If an institution’s loan portfolio is heavily disproportionate in fixed rate loans, it may be worth looking into offering more adjustable-rate loans to ward off a narrowing spread during rising interest rates.