How to Mitigate Ag Lending Risks

The following article is based on the whitepaper, The Ag Lender’s Survival Guide by Rob Newberry, SVP of Credit Risk Services at Abrigo. To download the whitepaper, click here.

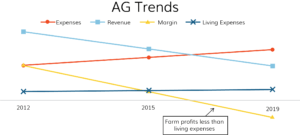

Today, most of farmers’ cash reserves that were built up in 2012-2014 are at, or nearing, depletion. If that trend continues, operating costs will begin outpacing revenue for many farms, and demand for ag financing will grow for community financial institutions. As operational expenses and living expenses rise and commodity prices continue to decline or be flat, then cash flow generated from farm operations will not support the farm long-term. While these trends are especially daunting for farmers, it also puts small ag banks at significant risk if economic trends continue.

Challenges for small ag banks

The sluggish growth in commodity prices and climbing expenses for farmers puts added pressure on Small ag banks (banks with total assets under $500 million and at least 15% of the loan portfolio in ag production or ag real estate loans) have significantly increased loan volume since 2012. This uptick in loan volume may be good for bankers, but it poses a significant risk to small ag financial institutions, as these institutions are more likely to use manual underwriting processes and use a more subjective analysis to credit risk.

The sluggish growth in commodity prices and climbing expenses for farmers puts added pressure on Small ag banks (banks with total assets under $500 million and at least 15% of the loan portfolio in ag production or ag real estate loans) have significantly increased loan volume since 2012. This uptick in loan volume may be good for bankers, but it poses a significant risk to small ag financial institutions, as these institutions are more likely to use manual underwriting processes and use a more subjective analysis to credit risk.

Assigning credit risk is tricky with ag lending since both environment and economic factors carry significant weight. For example, a wet spring in the Midwest will have a significant impact on crop production, but a forecasted abundance in crops worldwide will still hold prices down. A gradual increase in input costs and lower cash reserves create demand for higher average operating lines of credit requests from farmers, ultimately putting more strain on smaller operations.

The good news, however, is that there are strategies that small ag financial institutions can employ to mitigate the risks associated with ag lending.

Pay strategies

Pay strategies assess a borrower’s ability to pay back a loan. Common ratios used to assess pay strategies include:

- Debt service ratio

- Current ratio

- Debt to net worth

- Individual credit score (FICO).

Each institution has a different appetite for risk, so ag lenders should review current risk models and make adjustments accordingly. This could include using off-farm wages in certain calculations or moving to a more objective loan grading and approval process. An important component of pay strategies includes pricing loans according to the additional risk involved with the loan. If your institution is getting paid for the risk it’s acquiring, the higher the probability that it will overcome and thrive, even in less-than-ideal market conditions.

Save strategies

Save strategies aim to mitigate the number of losses incurred when a borrower stops paying back their loans. Common items used in save strategies include:

- Loan-to-value (LTV) – collateral-based lending

- Blanket security agreements

- Personal guarantees

- Government guarantees

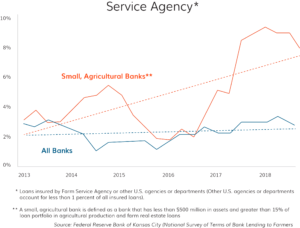

Recent data from the Federal Reserve shows that some small ag banks are beginning to leverage some save strategies. As seen in the graphic, there has been a recent surge in loans insured by Farm Service Agency (FSA) and other U.S. agencies, like the United States Department of Agriculture (USDA). With better save strategies, small agriculture banks can rely less on pay strategies.

Recent data from the Federal Reserve shows that some small ag banks are beginning to leverage some save strategies. As seen in the graphic, there has been a recent surge in loans insured by Farm Service Agency (FSA) and other U.S. agencies, like the United States Department of Agriculture (USDA). With better save strategies, small agriculture banks can rely less on pay strategies.

While agriculture lending has its fair share of risks, there are ways that financial institutions – small financial institutions in particular – can mitigate possible obstacles. It is critical that ag lenders be proactive in planning for the future and actively stress test the portfolio. Remember: the quicker problem loans or situations can be identified, the higher the chances are to circumvent potential losses. Ag loans are inherently risky, so it’s important to structure loans so that they qualify for guarantees and price loans based on the risk that the institution is taking on.