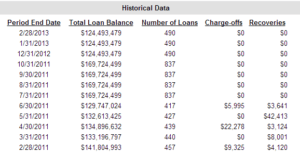

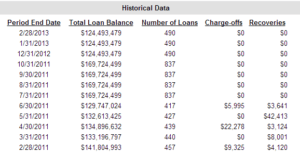

Traditional Historical Loss Rates

Loss Rate = (Charge-offs – Recoveries) / Average Loan Balance

A traditional historical loss rate calculation is the more commonly used methodology for identifying FAS 5 pools’ loss rates at community banks. These loss rates are typically assessed on a quarterly basis, often using an 8- or 12-quarter look-back period, although this will vary bank to bank, depending on what time horizon they deem to be appropriate.

Data needed for this assessment includes the total charge-offs and recoveries for each quarter that is incorporated into the bank’s reserve. Banks and credit unions must ensure the person responsible for the ALLL can access accurate information that ties to the general ledger when calculating loss rates and verifying accuracy. The charge-offs and recoveries for each pool should be outlined for each time period and tied to loan level detail as illustrated in the following example.

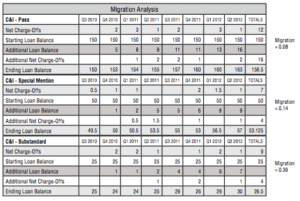

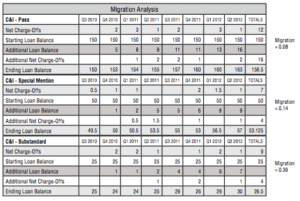

Migration Analysis

Migration analysis is a more granular and analytical process for calculating FAS 5 loss rates than the traditional historical loss rate analysis.

This loss rate calculation uses loan-level metrics to track the migration of loans to charge-off from different classifications in order to generate the estimated loss. Consequently, migration analysis can provide a more accurate and appropriate FAS 5 loss rate, but the data collection required for migration analysis is more data intensive and requires the bank to keep accurate risk ratings for each loan. See a poll showing why some institutions avoid migration analysis.

Below is an example of data needed for migration analysis. In this example, when examining the C&I Pass-rated loans in Q3 2010, we start with a loan balance of $150 with no net charge-offs. The next quarter shows $2 charged off. The calculation extends through 8 quarters, and we can assess that $12 of net charge-offs are experienced against the original $150 loan portfolio balances beginning in Q3 2010, giving us our 8 percent loss rate through the migration analysis. The idea here is to measure the migration to loss for a static group of loans in each risk classification and to use that measurement to apply a loss rate to the current balance of loans in that risk classification.