Mark Twain observed, “A thing long expected takes the form of the unexpected when at last it comes.” For example, the FDIC’s regulatory expectations for loan review seem quite expansive and encompassing, especially for an industry concerned about its non-interest expense ratio and the cost of its non-revenue-producing staff. Nevertheless, bankers must figure out how to adhere to the FDIC’s guidance on loan review systems, credit risk rating systems, loan review system elements, qualifications of loan review personnel, loan review personnel independence, frequency of reviews, loan review scope, review of findings and follow-up, and work paper distribution and reporting.

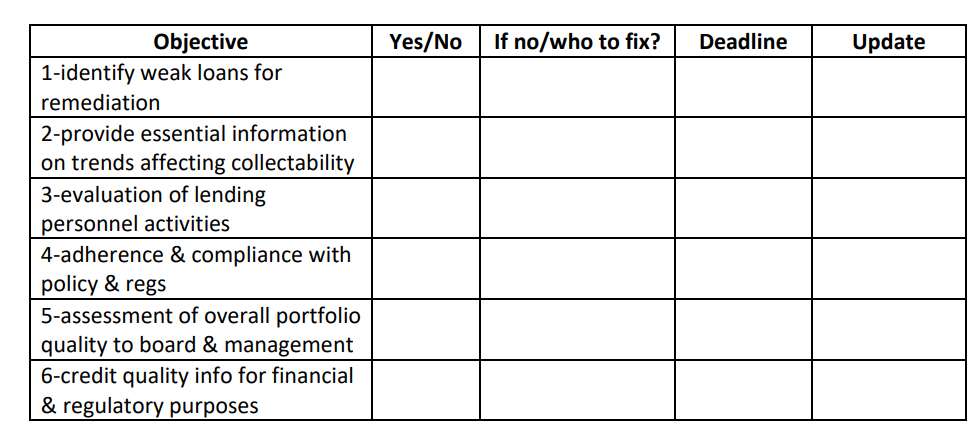

So, let’s get a sense of what regulators specifically expect loan review to do, and let’s start with loan review systems.