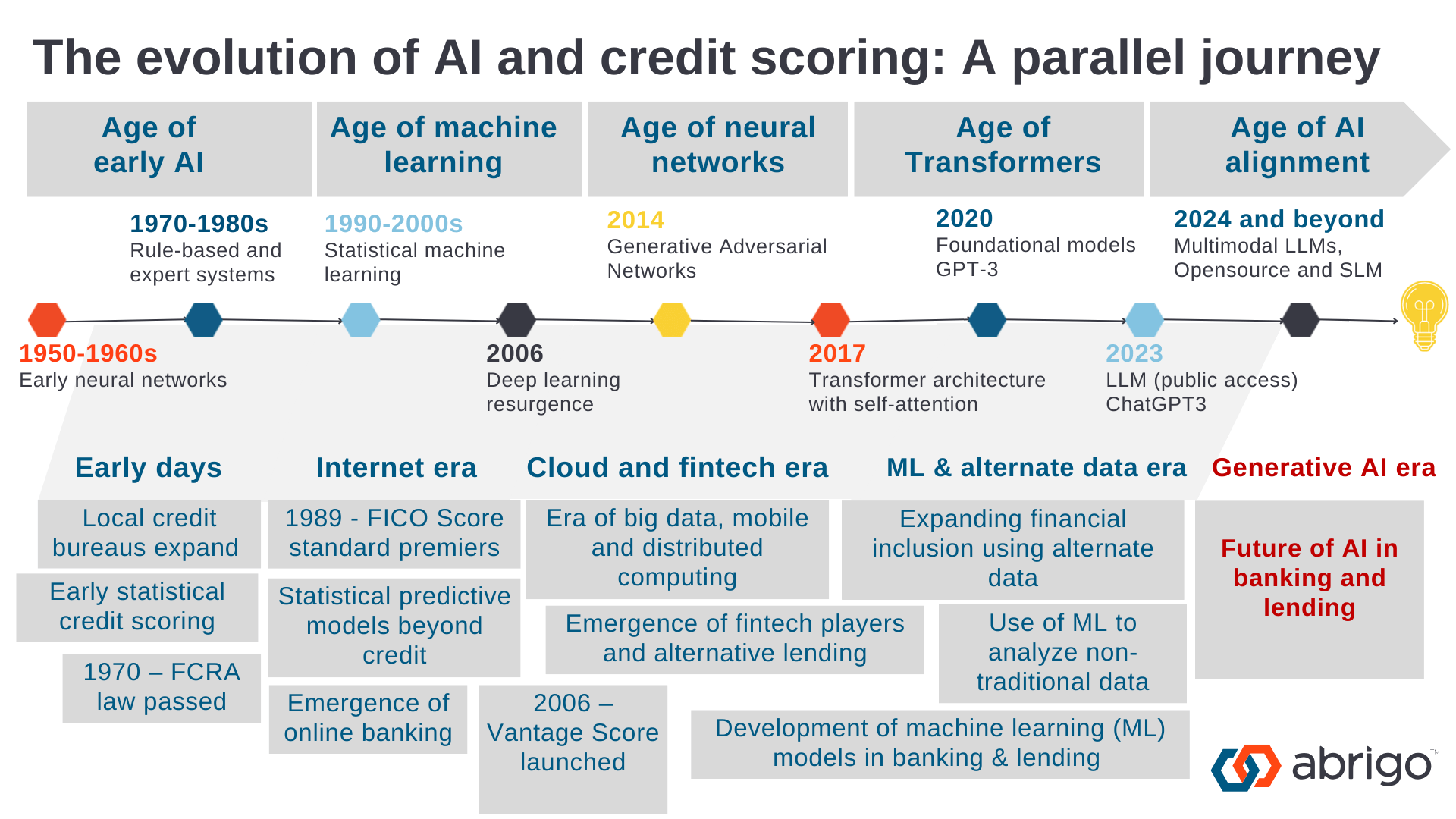

Lending’s evolution: A legacy of data-driven innovation

As AI advanced, banking and lending also evolved, consistently leveraging new technologies to improve decision-making and expand access to credit.

Let’s examine the significant technology milestones for lending and credit:

From qualitative assessments to quantitative models

Lending assessments historically were largely qualitative, relying on relationships and reputation. During the 1950s and 1960s, as neural networks started to come to the forefront of innovation, a lot of changes were happening on the lending side of banking. Credit bureaus, which were very localized at the time, began expanding to a more national footprint. Expanding these bureaus nationally enabled standardization in credit assessments. Banks also began adopting statistical methods and metrics to assess credit risk. They started using more quantitative information like debt-to-income ratios, debt service coverage ratios and other factors.

In 1970, Congress passed the Fair Credit Reporting Act to make sure information in credit reports was fair, accurate, and kept private. This law and later updates to it created new federal requirements surrounding the consumer information that lenders furnish to credit reporting agencies, which affected many lender processes.

The Internet era and predictive models

The 1980s and 1990s brought the rise of the Internet, which transformed how banks used data. FICO introduced its scoring system in 1989, providing a standardized scale for creditworthiness. Banks started to use statistical predictive models not only at the time of credit origination but also across the consumer journey. These models influenced marketing strategies, collections, and fraud detection tools.

Cloud computing, mobile technology, and financial inclusion

By the 2000s, cloud computing and mobile platforms allowed banks to serve customers in new ways. Many financial institutions had already established web channels through which customers could interact. Mobile applications became widespread, and lenders started to look at alternative data sources—like rent, utility payments, and telecom data—to expand access to credit and improve the accuracy of risk assessments.