3. Do we have a clear, robust governance structure in place for managing these risks?

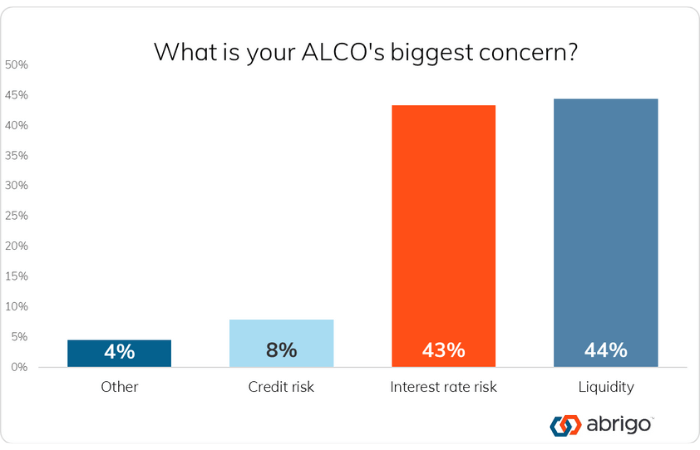

“The ALCO committee is responsible for managing your interest rate risk and liquidity,” Sharbel noted.

As a result, regulators are really looking to make sure that all ALCO members are aware of everything going on that could affect asset/liability management.

Regulators are not just concerned about financial institution’s liquidity. “It's not just your liquidity position because what they're finding is folks that don't have great liquidity positions, don't have a strong governance behind that.”

The liquidity and funds management process should be very clear in terms of policies and procedures, she added.

“Make sure that your ALM policy, liquidity policy, and contingent policies have been updated. They’re required to be done annually, but if you’re even close [to that timeframe], I’d get it done now.”

Sound governance includes policies and procedures for the daily analysis of liquidity and the funds management position, including what should happen when there is a liquidity gap. It should incorporate periodic monitoring through stress testing and spell out the periodic reporting of liquidity (how, who, and when) to senior management and the ALCO or board.

In Sharbel’s view, regulators will be closely watching how effectively institutions manage these governance aspects as part of their overall risk management approach.

4. What are our most significant concentration risks, and how could they impact our liquidity and interest rate risk?

The collapse of Silicon Valley Bank (SVB) and other recent bank failures illustrate the dangers of unchecked concentration risks. As Sharbel pointed out, SVB’s downfall started as a concentration risk—too much reliance on high-yield depositors and a concentration of investments because their depositors did not have a lot of lending needs. When rates rose, this turned into an interest rate risk issue, as the bank’s long-term assets were funded by shorter-term deposits, creating a mismatch.

Ultimately, SVB faced a full-blown liquidity crisis as it had to liquidate investments at a loss to cover deposit withdrawals. “Some of their investments were at 1%, yet they’re having to pay their depositors, 5%,” Sharbel said. The bank’s failure reminds ALCOs that concentration risks can create a domino effect, quickly affecting several areas of an institution’s risk profile.

Sharbel emphasized that regulators are watching closely for concentration risks and how those might cascade into others. They’ll want to see if institutions are adequately managing related risks that could affect liquidity and interest rate exposure.

5. Do we understand whether we are asset-sensitive or liability-sensitive, and how does this affect our margin?

Knowing if your institution is asset-sensitive or liability-sensitive is critical when preparing for changes in the rate environment. Sharbel noted that “most institutions are asset sensitive,” which means their assets are more sensitive to repricing than their liabilities, often increasing margin as rates rise. “The real concern is, if there's this much volatility going up, what happens when rates fall,” she said. As rates fall, asset-sensitive institutions may face margin compression, with variable-rate assets repricing downward while funding costs may not drop as fast.

Understanding this sensitivity can help financial institutions prepare strategies for margins, income, and funding so they can balance risk and return.

6. How well do we understand our clients’ behavior, particularly regarding core deposits, in a changing rate environment?

Understanding customer or member behavior is essential, particularly as rates change. Sharbel recommends core deposit studies to get insights into depositor patterns. Those insights are especially valuable in a falling-rate environment.

Institutions need to understand how customers or members might respond when rates drop, she said. Knowing these patterns can help adjust funding strategies and optimize deposit pricing.

In addition, depositor behavior has shifted in recent years. As a result, institutions can benefit from studies examining both historical and future depositor behaviors. A core deposit study looks at the institution’s pricing behavior (the beta and the lag in pricing) and the member or customer’s behavior (the decay) to inform pricing strategies.

A core deposit analysis that examines both historical and future depositor behavior considers factors like:

- deposit beta (how deposits change in response to rate shifts)

- decay (the rate at which deposits leave the institution)

- timing lags between market rate changes and deposit repricing.

These insights help institutions predict how quickly deposits might move to other products or institutions as rates move.

As noted above, banks and credit unions also need to understand how changes in prepayments could affect income and profits. A prepayment study helps identify the unique impact an institution could face as rates go down since every portfolio is different and since loans have different rates.