Financial institutions work hard to make sure their credit review systems have been perfected to meet regulatory expectations. And regulatory expectations for an effective loan review system often include objectives such as:

- identifying promptly loans with well-defined credit weaknesses so that timely action can be taken to minimize credit loss

- reporting essential information for determining the relevant trends affecting the collectability of the loan portfolio and isolate potential problem areas

- evaluating the activities of lending personnel

- assessing the adequacy of, and adherence to, loan policies and procedures

- providing the board of directors and senior management with an objective assessment of the overall portfolio quality

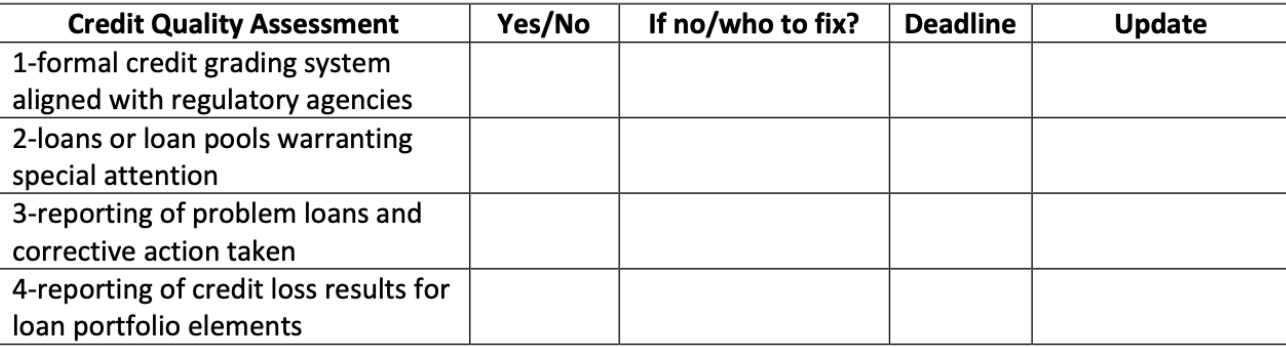

- providing management with information related to credit quality that can be used for financial and regulatory reporting purposes

The first objective’s call for prompt identification of weak loans infers that these loans are being monitored regularly, and a critical element of monitoring is an organization’s risk rating system, so let’s examine credit grading in more detail.