Determining whether their data is accurate and thorough enough to estimate future losses can be a struggle for some credit unions. Thankfully, there are flexible options available depending on the type of data available to your institution.

“The standard gives you a lot of options on how to estimate future credit losses,” said Garver Moore, Managing Director of Abrigo Advisory Services. “And those different options have different data requirements, including the amount data you need, how far back it goes, and what that data covers. Yet, even if you have data, that doesn’t mean that you have intelligence. If you have 15 years of granular data as a small credit union, there might not be like a material loss in that entire dataset, which wouldn’t tell you anything meaningful.”

If a credit union finds that it lacks data, has inaccurate data, or struggles with data gaps, it will likely need to make assumptions based on peer or industry data. For a successful CECL implementation and to satisfy examiners, assessing the credit union’s data situation is a critical first step.

Methodology choice is vital in CECL implementation

Data availability should guide a credit union’s decision to leverage a particular methodology or methodologies. “It’s important to dispel the myth of, ‘I need to just try every option on every loan type,’ especially when it doesn’t map out to what the institution does,” advises Moore. While considering various scenarios is generally a good idea, there is no expectation to model every possible permutation. For example, some methodologies, like vintage analysis, can be ruled out quickly because the institution’s data is simply insufficient, and discounted cash flow or remaining life would be a better approach.

Regardless of the credit union’s methodologies, documenting the decision is critical. Not every methodology will work for a financial institution’s unique circumstances, and there will likely be significant back and forth during CECL committee discussions before a credit union determines the direction it wants to go in. Examiners, however, will lack the context of the discussions and strategies unless these processes are well-documented. Credit unions must ensure examiners understand why the institution ultimately decided on its chosen methodology.

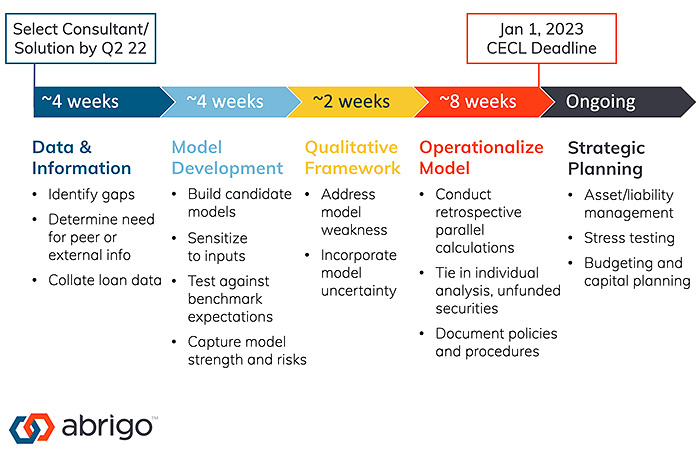

Testing, discussing, and deciding do not happen overnight. Credit unions must devote enough time to each area for successful CECL implementation.