Dave Koch, Director of Abrigo Advisory Services, also contributed to this article.

Asset/Liability

Asset Liability Modeling

Deposit Modeling

Deposit Pricing Optimization

Portfolio Risk & CECL

Understanding your core deposit study: Reading between the lines

April 28, 2022

Read Time: 0 min

How core deposit analytics help banks and credit unions plan for rising rates

Core deposit analytics provide a wealth of information for strategic planning, deposit pricing, product development, and more. How to get the most out of a core deposit study.

Takeaway 1

Strategically focused financial institutions understand the benefit of regularly updating core deposit analytics.

Takeaway 2

Understanding the key outputs of core deposit studies helps management develop deposit management strategies through pricing.

Takeaway 3

Outdated core deposit analytics mean missed opportunities for banks and credit unions in the current environment.

Core deposit study results

Strategically focused institutions leverage core deposit analytics

Across the banking industry, views on the importance of conducting a core deposit study on a regular basis vary greatly. Many financial institutions update their study every four to five years. Others are on top of the data every year.

Why such a variance in approaches? Well for one, the math and process used in the study feel a bit like voodoo math, where the results are hard to believe, and the only benefit appears to be generating an input for the asset/liability management (ALM) model for measuring risk exposures. Often, folks do not value the exposure reporting either, so they take the approach of “Let us just get something done and move along.”

However, in more strategically focused institutions, there is an understanding of the wealth of information that a good core deposit study can uncover. Of course, these institutions use the study results for updating assumptions in the ALM process. But more importantly, they also use the results of core deposit analysis for strategic planning, deposit pricing, product development, and other key decisions.

The real value here is to leverage the results.

As we move into a rising-rate environment, it is critical to decipher the findings from a core deposit study so you can understand what assumptions to use in models going forward and how your institution should plan for new products, offer rates, etc. to remain not only competitive but also profitable.

To better understand the importance of good core deposit analytics, let us look at a couple of the main outputs of a core deposit study.

Beta, lag

Outputs of core deposit analytics

One of the major outputs of a core deposit study is the beta, which represents how much of the change in market rates you will pass along to the customer or member in the form of rate changes on a product line. For example, if rates go up 200 basis points, you might pass 100 basis points on to your customer or member. That would be a beta of 50%.

As a part of the beta study, we often find that institutions “lag” market-rate movements.

Strategic planning Data

Learn more about core deposit analysis

Lag represents the amount of time it takes to pass on the rate change to the customer or member. For example, we might look back and see that your institution took six months to begin moving rates once market rates began moving. Or perhaps it took six months to fully recognize the 100-basis point increase to your customers or members.

To manage spread, financial institutions looking to retain funding try to balance the minimum amount of the interest rate increase they must pass on to customers or members to keep them from pulling their deposits and going elsewhere to earn more interest. These funds that are more rate sensitive are referred to as surge balances. Surge balances are funds tied to customers or members who are expecting higher rates and are willing to move their funds to an alternative investing opportunity. These funds are likely to carry a higher cost than the non-surge funds when rates rise. Why? Because they will move to a higher-priced product offering.

When reviewing historical beta analysis, the beta on the surge balances is often significantly higher than that of other core funding and helps define why funding costs increase more in the model.

During rising rates

Using betas and lags for deposit management in banks and credit unions

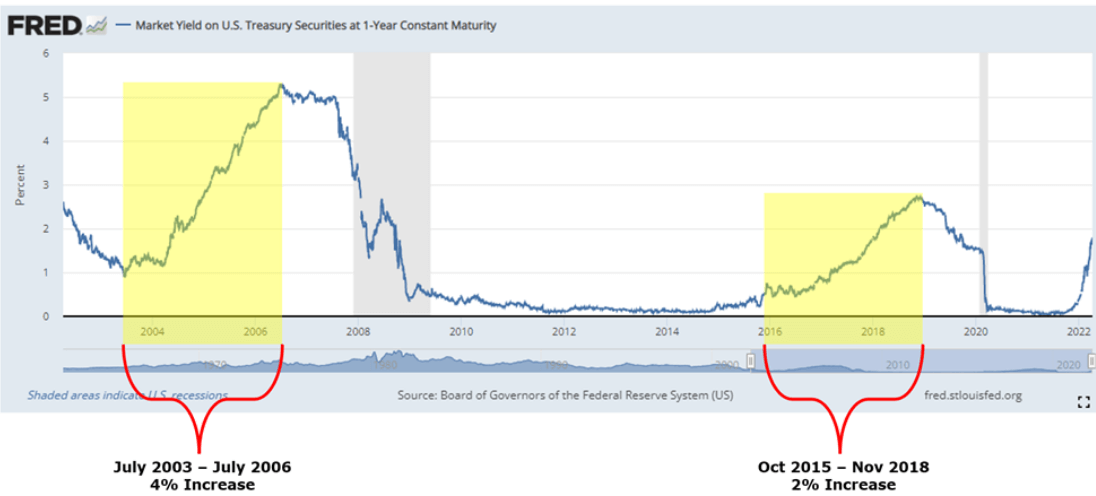

If you look at the last two “up” or rising-rate environments, you might see different pricing strategies used by management to maintain core deposits. For example, coming out of a more volatile rate environment in the early 2000s, customers or members were potentially more rate sensitive. Rates also went up over 4% during that three-year period. That would have driven management teams to use higher betas and shorter lags to keep core deposits. The last rising-rate environment from 2015-2018 was after a prolonged period of almost zero rates. Rates only climbed around 2% over that three-year period. Consumer’s expectations of earning interest were potentially much lower. The steepness of the rate increase was much lower. Management teams might have decided not to pass any rate increases on and were willing to take the risk of losing core deposits. See graph below.

If your institution had core deposit segments for which you did not move offering rates in the last “up” environment, and thus we calculate a zero beta, what should you use in your ALM modeling and forecasting now?

One option and another way to understand the change in costs of your core deposits in an “up” environment is to look at core deposit interest expense at a global level relative to the change in market rates. This global beta captures the behavior of your customers or members migrating funds into other higher-yielding deposit accounts at your institution. Understanding this change in mix in your core deposit accounts by existing customers or members will also help identify potential impacts of your current pricing strategies on decay rates and average life of your current core deposit accounts.

A second, popular alternative for modeling core deposit sensitivity is to use data from the “Interest Rate Risk Statistics Report” produced by the OCC. This report provides industry averages for financial institutions of different asset sizes. However, it is highly unlikely that the industry data in the report reflects your past or future pricing decisions in a rising-rate environment. In addition, the industry average data suffers from the hidden “surge beta,” unless those increases are being added in to the overall core account betas. Finally, the OCC report shows what institutions are using in their ALM models, not necessarily what their actual customer behavior has been.

Profitablity, growth

An outdated core deposit study means missed opportunities

If you have not updated your core deposit data recently, here is an analogy. It’s like trying to navigate the internet today using Windows Vista. Vista may still work, but you are opening yourself to many vulnerabilities and missing out on more effective tools to find what you are looking for on the web. With outdated core deposit analytics, you are also ultimately missing out on opportunities for profitability.

For those financial institutions with a more recent core deposit study, ask yourself the following when reviewing your results:

1. Does the information provided in the core study make sense?

2. Is past behavior a true reflection of what you will do going forward?

3. How has the pandemic impacted customer behavior or your deposit pricing strategies?

4. How can you leverage the results of your core deposit analytics to better run your financial institution?

Understanding the answers to these questions is a key component to your overall funding strategy. When liquidity starts to get tight, where will you go to acquire or raise more funding? Will you raise funds internally through changing deposit pricing strategies on betas and lags in existing or new core deposit accounts, or will you go to the wholesale market? Your core deposit study offers many answers. In some cases, you will need to dig a little deeper into the core deposit analytics results to identify the correct assumptions to use in your ALM models that will identify the risk to your core deposits in a rising-rate environment. But investing in this effort can provide huge returns for your institution.

Learn how core deposit analytics helped improve forecasting at this financial institution.

keep me informed

read success story

About the Author