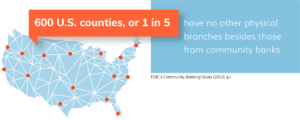

The banking landscape has changed dramatically in recent years, especially for financial institutions. “Community bank” typically refers to financial institutions under $10 billion in assets and a focus on their local communities, although there are no explicitly stated criteria. Even though community banks make up a small share of total assets and deposits, 13.5% and 13.9%, respectively, these institutions play an integral role in providing much-needed services to banking customers, accounting for 97% of all banks in the U.S, according to FFIEC and FDIC data.

Community banks provide unique and important banking services for their customers, but they also face significant obstacles. In the recent publication, Community Banks’ Ongoing Role in the U.S. Economy, supervisory and risk specialists from the Federal Reserve of Kansas outline top challenges and opportunities regarding the future of community banking. Despite the headwinds, there are many opportunities for community banks to thrive.

While community banks still make up a vast majority of the overall bank population, their share is declining significantly. The number of community banks has nearly been slashed in half since 2000, from 8,315 to 4,277 banks. Much of this decline can be attributed to consolidation and mergers and acquisitions (M&A) to achieve economies of scale.

A large volume of research has been dedicated to assessing the economies of scale that can be recognized through mergers, particularly for the smallest banks. Acquisitions allow organizations to spread costs across a larger asset base, recognize synergies within business lines, reduce staff, and consolidate branches in overlapping markets.1

Today, community banks are at a critical crossroads: innovate or be left behind (or acquired).