Now that the Fed has lowered interest rates, financial institutions will want to carefully monitor current loan interest rate trends in their markets to remain competitive as rates drop.

Loan pricing software can help banks and credit unions structure and optimize pricing to ensure the institution is adequately compensated for risk. But it’s often difficult to find factual, comprehensive industry-wide data about interest rates on the new loans being made at banks and credit unions. Lenders often rely on a small sample or on information collected informally or through surveys.

Real-time pricing trends provide a powerful tool for maximizing net interest margin. Monitoring the pricing trends for the loan types and geographies important to the institution better prepares lenders to strategically plan for upcoming loan repricings and maturities.

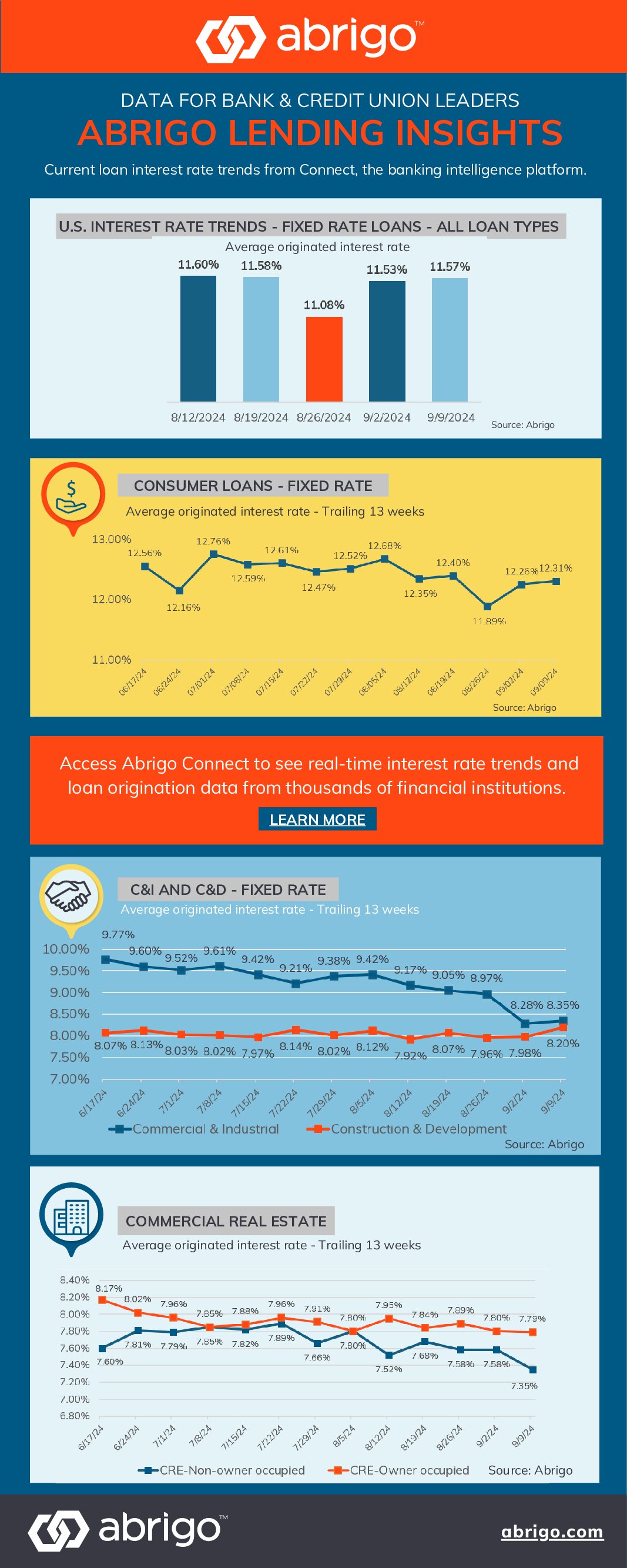

Below are current loan interest rate trends from Abrigo Loan Origination Benchmarks, which provides real-time loan origination data curated from thousands of financial institutions. The benchmarks are powered by Abrigo Connect, an AI-powered banking intelligence solution.

The charts show the average interest rate for fixed-rate loans originated between June 17 and Sept. 9. Included are average originated interest rates for consumer loans, commercial and industrial (C&I) loans, construction and development (C&D) loans, and commercial real estate (CRE) loans.