The coronavirus has sent shockwaves through the markets around the globe. To mitigate disruption to the economy, the Federal Reserve made its second emergency cut to interest rates on Sunday, marking the largest emergency reduction in the Fed’s history. Low interest rates and slowing growth in loan demand can put community financial institutions in a difficult position. Eliminating lending inefficiencies and mitigating any increased risk should top the priority list for community financial institutions across the country.

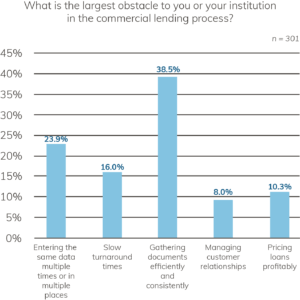

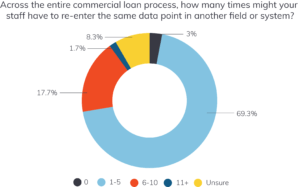

Abrigo’s 2020 Business Lending Readiness Survey identified a number of pain points that thwart business lending growth, from document gathering to lengthy loan turnaround time. Here are the top five lending inefficiencies holding community financial institutions back and how to overcome these challenges to stay competitive in an uncertain economic climate.

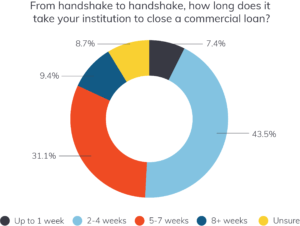

Wrangling documents, manual data entry, and other inconsistent and time-intensive processes make it difficult to get an answer back to borrowers or members quickly. Only 7% of respondents said that their institution could turn around within a week.

Wrangling documents, manual data entry, and other inconsistent and time-intensive processes make it difficult to get an answer back to borrowers or members quickly. Only 7% of respondents said that their institution could turn around within a week.