Examine loan review staffing challenges

Recruiting and onboarding skilled loan review staff can be a difficult task, but staff are a vital part of effective loan review. One way to gauge your loan review function's efficacy and readiness for the future is to examine staffing.

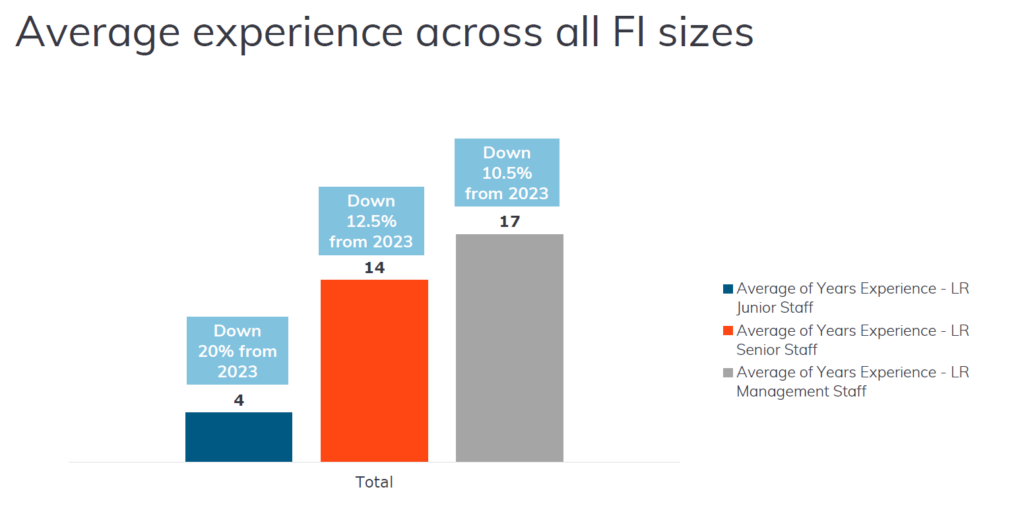

Many organizations encounter difficulty in attracting and retaining new members on their loan review teams. Most loan review departments are heavily reliant on staff with 10 or more years of experience, as shown in this graph from the 2024 Loan Review Survey. However, as long-serving staff retire or leave, those who remain are not gaining experience quickly enough to keep the average experience level high. From 2023 to 2024, there were double-digit drops in the years of experience across all levels of loan review team members. This trend puts a strain on teams, threatens the effectiveness of credit risk review, and heightens institutional risk, underscoring the need for job support.

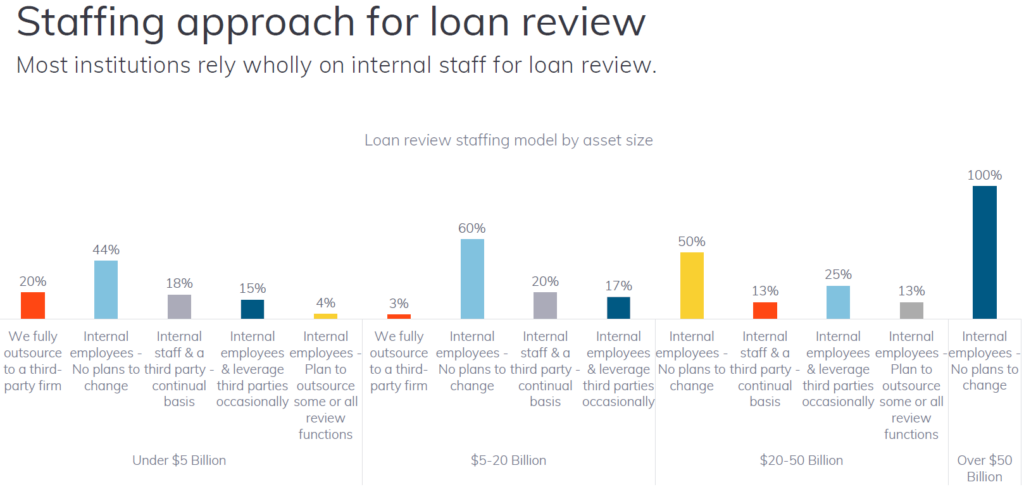

Abrigo’s 2024 survey also revealed that banks and credit unions of all sizes predominantly rely on internal resources for loan review. Only 20% of institutions under $5 billion in assets and 3% of those between $5 billion and $20 billion fully outsource independent loan review. However, substantial shares of those surveyed use third parties either on a continual basis or occasionally.

Increased workload and a talent shortage emerge as the top reasons prompting banks to look beyond their organization. While not a solution for the talent shortage, automation can optimize processes, often at a fraction of the cost of additional resources. Leveraging loan review software can help financial institutions maximize their existing resources.

Loan review software offers the following benefits:

- Streamlines manual efforts, allowing staff to focus on high-value tasks

- Enhances review consistency, reducing process waste

- Facilitates smoother interactions between team members and departments

- Provides cost savings compared to additional resources or outsourcing

- Enables more accurate assessment of resource needs

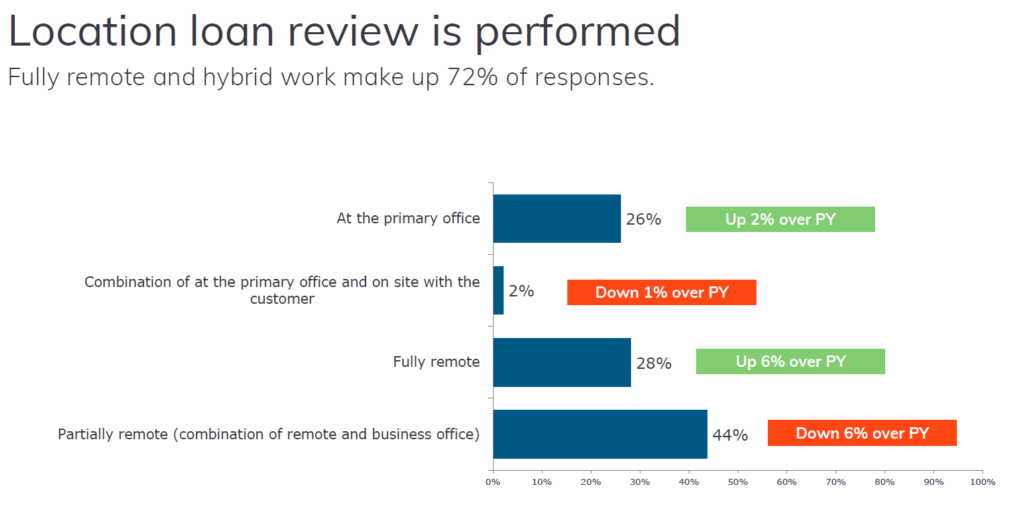

Many banks and credit unions find that reviewing loans with automated technology that runs on the same platform as their loan originations offers their staff greater functionality, which can mitigate or eliminate those staffing woes. For smaller institutions especially, software makes tracking productivity among teams, geographies, and other factors easier and more efficient. That helps quickly achieve needed ROI for loan review software.

In addition to providing a more efficient credit risk review, a loan review solution can provide other analytics to support staffing requests to minimize exam risk as an institution grows.