Looking for information on growing your bank or credit union while the Fed is raising interest rates? See this newer post, "Growth in a rising-rate environment."The FOMC is charged with the difficult task of maximizing employment while holding consumer prices steady with targeted inflation under 2% annually. While low interest rates can spur strong economic growth and keep investors happy, financial institutions are typically more profitable with a steeper yield curve when overall interest rates are higher. If the pandemic has taught us nothing else, it is that “typical” does not fit well in our vocabulary and that economic recovery is not a straight pathway.

Asset/Liability

Deposit Pricing Optimization

Deposit Pricing Strategy

Lending & Credit Risk

Loan Origination System

Loan Pricing

Member Business Lending

Portfolio Risk & CECL

Waiting (patiently?) for interest rates to rise: 4 growth moves to prepare for Fed rate hike

October 21, 2021

Read Time: 0 min

With a Fed rate hike looming, here's how to position your bank or CU

The timing of a rate hike by the Fed is uncertain, but credit unions and banks can act now to create increased earnings more quickly.

Takeaway 1

The economic recovery's uneven pathway has made it difficult for financial institutions to plan on the timing of a Fed rate hike.

Takeaway 2

Financial institutions are eager to deploy excess liquidity and invest in anything paying more than nothing and are looking for actions to take now.

.

Takeaway 3

Exploring lending opportunities and examining loan and deposit pricing are among steps that make sense while awaiting a Fed rate hike.

Economic Indicators

Factors playing into inaction on Fed rate hike

U.S. Department of Labor Secretary Marty Walsh called the jobs report for September “disappointing.” The unemployment rate dropped again in September, down to 4.8%, much closer to a natural unemployment rate of 3.5-4.5%. This is the lowest reported unemployment rate since the beginning of the COVID-19 pandemic. Although trending in the right direction, the additional 194,000 new jobs added in September is less than half of what was anticipated.

In response to the economic instability amid the pandemic the Federal Reserve has been buying billions in mortgage and Treasury bonds to ensure that financial markets continue to run smoothly, suppress term loan rates, and increase consumer spending. Currently, the Fed is purchasing $40 billion in mortgage-backed securities and $80 billion in Treasury bonds each month. Chairman Powell indicated that this action would likely be tapered in the final quarter of 2021 with a formal announcement expected later this quarter.

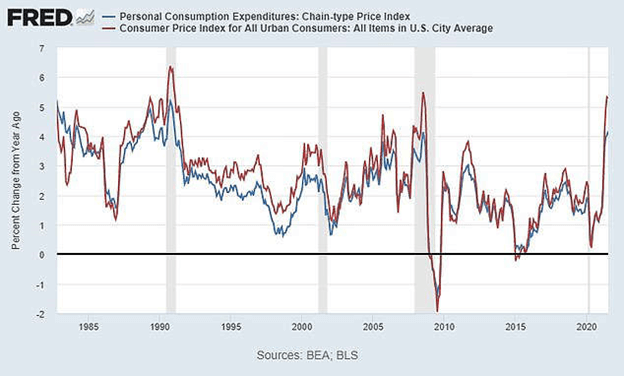

However, inflation is at the highest since November of 1990, as measured by the price index for personal consumption expenditures (PCE) and is trending upward. The PCE price index was up 0.4% for August 2021, up 4.3% from one year ago, and considerably higher than the Federal Reserve’s objective. Fed Chair Jerome Powell has suggested that these high measures are likely temporary and will recede.

Why the Wait?

Fed balancing timing of hikes, economic recovery

Most financial institutions welcome interest rate hikes, the sooner the better, as higher rates and profitability are intricately connected. Increases in interest rates are a signal the economy is continuing its recovery which will inherently increase lending activity by both volume and rate. As profitability increases, stock prices follow suit. Financial institutions are ready and waiting to deploy their excess liquidity and invest in anything paying more than nothing.

Why does the looming rate hike seem to be a moving target? It is quite a conundrum. Increasing interest rates too soon could slow the gains made in economic growth, erode consumer earning power through inflation and spook investors. Waiting to increase interest rates could mean a more aggressive approach to inevitable interest rate hikes, amplifying the roadblocks to economic recovery. And so, we wait.

Get the latest on how to plan for growth. Watch the webinar, "Capital planning for banks & credit unions: gearing up for growth in 2022"

Watch WebinarFinancial Institution Actions

How to prep for growth in the meantime

While waiting on interest rates to move, financial institution have several options. Here are four:

Explore lending opportunities

Explore lending opportunities

It is a good time evaluate your lending footprint, mix, and think outside of the box. Markets that you have yet to enter or where you have been a passive participant should be re-evaluated. Participations have become an attractive alternative to minimize risk and find extra yield. Additionally, the consumer credit market continued its expansion to the tune of $17 billion in July of 2021..

Ensure happy customers

To attract lending opportunities, you can enhance the customer experience in both time and ease. Now is an excellent time to evaluate how your institution stacks up in an extremely competitive digital market. Loan origination systems (LOS) automate this process, increasing efficiencies in both the customer application and the institution’s decision-making process. Financial institutions can draw upon the Paycheck Protection Program experience to ensure that the lending process is quick, simple, and easy.

Examine your loan pricing

Examine your loan pricing

A comprehensive evaluation of current loan pricing strategies may also yield, pardon the pun, greater returns. Profitability in this industry is based upon spread so a thorough appraisal of the risk/return trade-off in each loan category is warranted. With cheap funding, a low yielding loan may seem more attractive than on the initial glance. Additionally, hedging strategies may assist financial institutions in meeting customer needs while managing their interest rate risk.

Evaluate your deposits

Evaluate your deposits

Finally, funding is cheap, and the deposits keep coming in. Second quarter of 2021 saw an increase in total deposits of $271 billion, $175 billion in non-interest-bearing deposits. Careful consideration of current deposit pricing strategies, policies, programs, and offers can affect immediate, positive change in your net interest margin.

Conclusion

In short, while an increase in market interest rates is almost certain, the timing and speed is unclear. For most financial institutions this cannot come soon enough. While waiting, there are several maneuvers financial institutions can take that could translate into increased earnings.

Stay up to date on interest rate risk and other asset/liability management issues.

About the Author