When evaluating FAS 114 (ASC 310-10-35) loans for impairment in the allowance for loan and lease losses, financial institutions are given three options by accounting guidance: the Fair Market Value of Collateral method, the Present Value of Future Cash Flows method, and the seldom-used Loan Pricing method. The resulting reserve amount can vary widely depending on the method used, so it is critical for financial institutions to use the most appropriate method from an accounting standpoint. In part I of this series of posts on FAS 114 valuation methods, the Fair Market Value of Collateral method will be discussed.

The Fair Market Value of Collateral method

As the most widely used valuation method to evaluate a loan for impairment, the Fair Market Value of Collateral method starts with an assumption that the loan will be repaid through the liquidation of the collateral (hence the term “collateral-dependent”). The contention with these loans is determining whether or not a loan should be considered collateral-dependent.

When the borrower is no longer able to service the debt through payments, the creditor looks at the collateral as the source of repayment. A loan should be considered collateral-dependent when the only source of repayment expected is the underlying collateral and no other expected cash flows. The amount the institution expects to recover is the value of the collateral, less any liquidation costs such as selling costs, transfer taxes, legal fees or maintenance costs. Also, a current appraisal should be used to estimate the value of collateral.

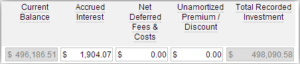

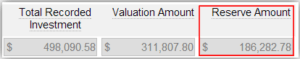

The identified collateral value should be reduced by any estimable discounts and/or liquidation costs in order to determine the fair value of the collateral. The difference between the total recorded investment in a loan and that loan’s respective fair value of collateral should be identified as the specific impairment and consequently reserved against. If the fair value of the collateral exceeds the total recorded investment, no reserve will be needed (though the loan may still be considered impaired).