The true value of AI goes beyond efficiency

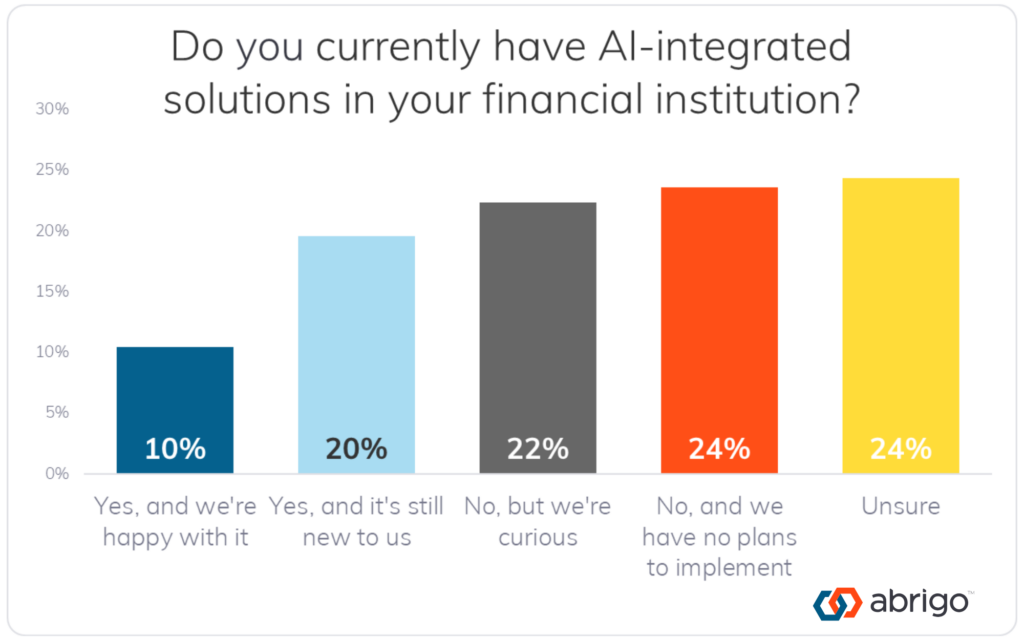

If generative AI technology alone is projected to unlock between $200 billion and $340 billion in value annually for the banking sector, then why are nearly half of financial institutions still on the fence about adopting AI-integrated tools?

That’s what a recent Abrigo poll of webinar attendees found. Another 24% reported no plans to implement AI-integrated solutions, and only 30% said they’re using such tools.

That’s what a recent Abrigo poll of webinar attendees found. Another 24% reported no plans to implement AI-integrated solutions, and only 30% said they’re using such tools.

One reason financial institutions are reluctant to “buy in” to AI-integrated tools is that many see its central value as making the workforce more efficient -- doing more work in the same amount of time. If AI merely makes people more efficient, its true potential is missed. Efficiency alone doesn’t set a financial institution apart. Instead, an AI strategy that focuses on making staff more effective can create competitive advantages to allow some banks and credit unions to punch above their weight.