This article is substantially updated from a 2015 blog post.

Loan review is a periodic review of bank and credit union loan portfolios in order to gauge their overall risk profiles. The assessment of loan portfolio quality is then provided to senior management and the board of directors. This assessment often provides an early warning of deterioration(s) in credit quality and allows management to take steps to mitigate the risks.

The scope of the review and the way it is performed will vary from institution to institution. However, there are a few fundamental principles that should be followed within every loan review. As highlighted in a recent Abrigo whitepaper, Effective Loan Review, the following components should be included in their loan review function:

- Review for accuracy of credit grades assigned by lenders

- Review of the quality of credit underwriting

- Identification of any deviations from loan policy guidelines

- Confirmation of borrowers’ compliance with loan covenants

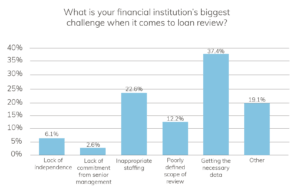

Unfortunately, loan review departments often have weaknesses that can prevent them from being fully effective. Ancin Cooley, CIA CISA, Principal and Founder of Synergy Bank Consulting and Synergy Credit Union Consulting, outlines three common weaknesses with loan review processes and programs:

- a lack of independent assessments

- poor documentation and reporting

- a lack of talent development.

Information challenges are a significant issue for many banks and credit unions, even beyond the loan review function. The loan review process requires loan-level information that often needs to be pulled from different sources within the institution, including the core processing system, third-party software solutions, and usually a number of manually maintained spreadsheets. Getting current data to the appropriate parties and reporting on the loan portfolio from these various stovepipe systems can prove difficult and can make the loan review process more cumbersome.

Information challenges are a significant issue for many banks and credit unions, even beyond the loan review function. The loan review process requires loan-level information that often needs to be pulled from different sources within the institution, including the core processing system, third-party software solutions, and usually a number of manually maintained spreadsheets. Getting current data to the appropriate parties and reporting on the loan portfolio from these various stovepipe systems can prove difficult and can make the loan review process more cumbersome.