With just weeks left to complete CECL implementation, how are banks and credit unions doing?

What are their biggest challenges with the current expected credit loss model? How has CECL implementation impacted their operations and reserves for credit losses?

The Q1 2023 compliance date is near for smaller SEC-reporting financial institutions and private or not-for-profit banks and credit unions, and progress is decidedly mixed, according to the Abrigo 2022 CECL Survey. Many institutions have made the most of the extra time the Financial Accounting Standards Board (FASB) provided when it delayed implementation. Others are still getting plans off the ground, Abrigo’s CECL implementation survey found.

In many cases, financial institutions adopting CECL for the 2023 deadline are tracking ahead of where SEC registrants were as they faced a 2020 deadline. The 2022 CECL implementation survey is the fourth such analysis since 2017 by Abrigo, which has worked with hundreds of financial institutions on CECL implementation.

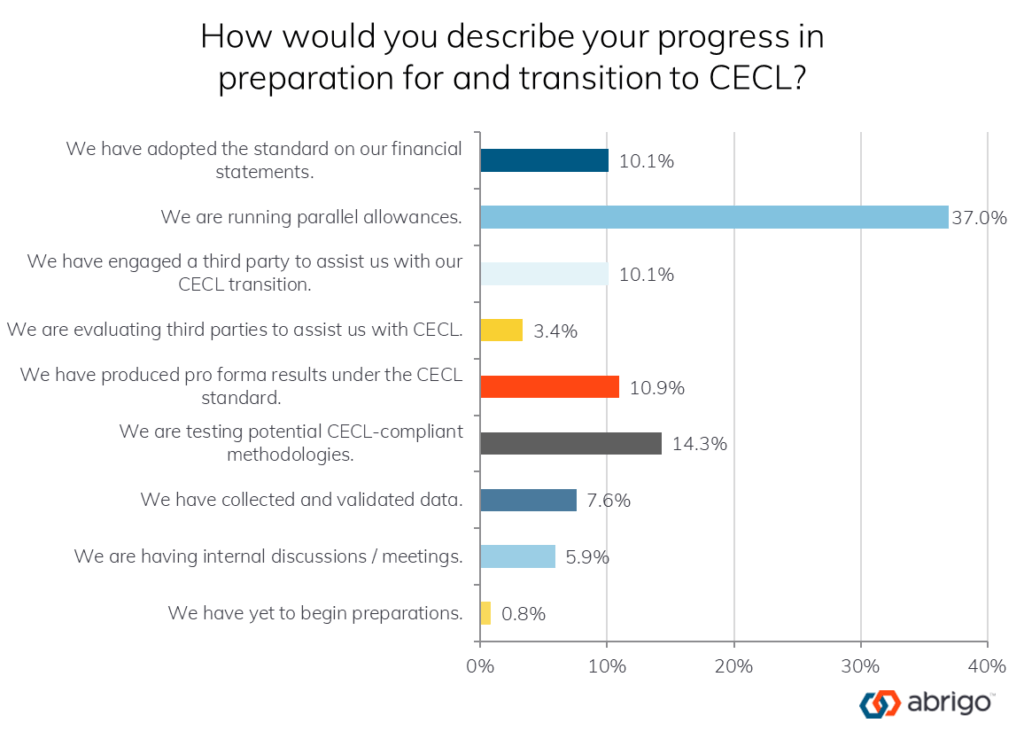

One in every 10 bankers surveyed this year has adopted the standard on financial statements. Another 37% said they are running parallel allowances.

Compare this to Abrigo’s 2019 CECL Survey responses, when no banks or credit unions had completed adoption, and less than 7% of all institutions were running parallel allowances.

Most bankers (86%) indicated they’ve moved beyond data collection in 2022, even if they haven’t yet adopted the standard (i.e., they are testing methodologies, have produced pro forma results, are running parallel calculations, or are evaluating/have engaged a third party to assist).

However, some banks and credit unions (8%) remain at the CECL starting line. Their institutions are either having internal discussions and meetings or, in the case of 1% of respondents, have yet to begin preparations.

“Many institutions are well on their way to being ready, but others are still working through the process,” said Garver Moore, Managing Director of Abrigo’s Advisory Services.