In part I of this post on FAS 114 (ASC 310-10-35) valuation methods, the Fair Market Value of Collateral method was discussed. This method is used when a loan is expected to be repaid through the liquidation of collateral. In part II of this post below, the Present Value of Future Cash Flows method is discussed.

The Present Value of Future Cash Flows method

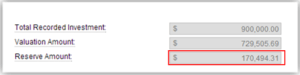

While the Fair Market Value of Collateral method is the most widely used valuation method for evaluating FAS 114 loans in the loan loss reserve, the Present Value of Future Cash Flows method is the second most popular. It should be used when there is an expectation of cash payments from the borrower. Troubled Debt Restructures (TDRs) fall into this category because these loans have been restructured in order to provide for future payments from the borrowers for at least some portion of the recorded investment.

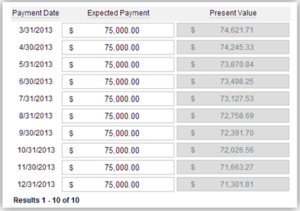

The Present Value of Future Cash Flows evaluation should use the effective (original, contractual) interest rate as the discount rate for the cash flows. For the analysis, the institution should set up a month-by-month payment schedule with each month discounted appropriately.