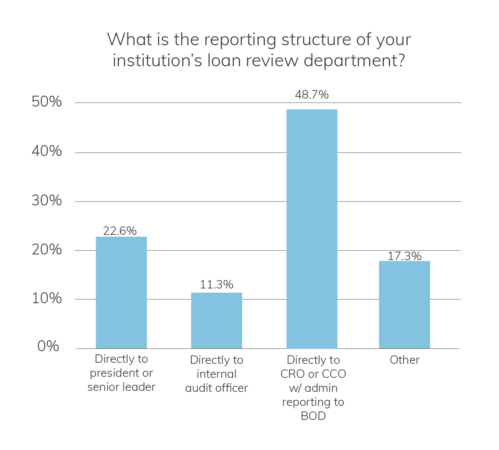

In addition to organizing the loan review function, determining the appropriate reporting structure for an internal loan review department is another important consideration. The reporting structure should be organized in a way that allows for testing and open-ended examination. Again, independence and objectivity are essential to an effective loan review, which should be reflected in the structure of reporting to the board or board committee.

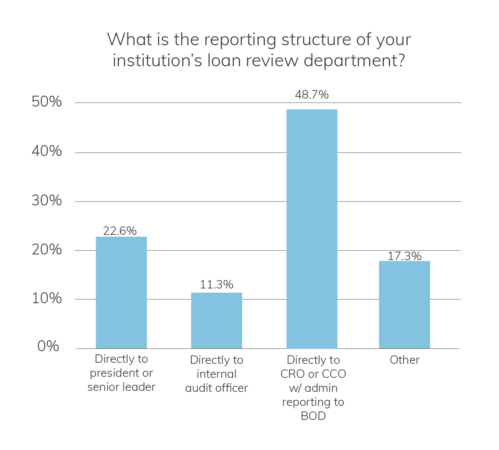

There are two primary options for reporting structures, according to Cooley. The first is an “audit” loan review reporting structure, which consists of the loan review function reporting up through the audit committee. This structure allows for a more objective view of risk ratings. In the survey, just 11% of institutions report directly to an internal audit officer.

There are two primary options for reporting structures, according to Cooley. The first is an “audit” loan review reporting structure, which consists of the loan review function reporting up through the audit committee. This structure allows for a more objective view of risk ratings. In the survey, just 11% of institutions report directly to an internal audit officer.

Other banks and credit unions, often larger institutions, may report directly to a Chief Credit Officer or Chief Risk Officer or directly to the board of directors. Nearly half of survey respondents said that their institution’s loan review department reports directly to the Chief Risk Officer or Chief Credit Officer, or the board of directors. Less than a quarter of institutions report directly to the president or senior lender.

Cooley warns against the latter option, as it may create an independence issue. “A common deficiency in loan review programs is reporting to the Senior Lender or Chief Credit Officer, as this would impair the function’s independence,” he said in Abrigo’s Effective Loan Review whitepaper.

If the function is not entirely independent, it could likely impair the ability to get the “fullness” of what they need to communicate.

An effective loan review process can help financial institutions grow by taking selected risks and avoiding regulatory woes. However, the loan review process must remain independent to be successful. The way the loan review function is organized and how it is reported can significantly affect the independence of the function.

There are two primary options for reporting structures, according to Cooley. The first is an “audit” loan review reporting structure, which consists of the loan review function reporting up through the audit committee. This structure allows for a more objective view of risk ratings. In the survey, just 11% of institutions report directly to an internal audit officer.

There are two primary options for reporting structures, according to Cooley. The first is an “audit” loan review reporting structure, which consists of the loan review function reporting up through the audit committee. This structure allows for a more objective view of risk ratings. In the survey, just 11% of institutions report directly to an internal audit officer.