Peer Identification for CECL and Other Credit Risk Applications

The past is the preferred fallback when estimating future results, but when a financial institution hasn’t experienced much credit deterioration or loss, it can consider its own history as well as a broader set of experience. In this session, Abrigo advisors will discuss using peer cohorts to construct credit risk models when applying the current expected credit loss (CECL) standard, along with important considerations in doing so. Practices for identifying and using peer data will apply to other modeling exercises such as stress testing, capital planning, asset/liability management (ALM), and valuation and are based on years of implementing credit risk models for clients of diverse sizes and complexity.

Watch the webinar to learn:

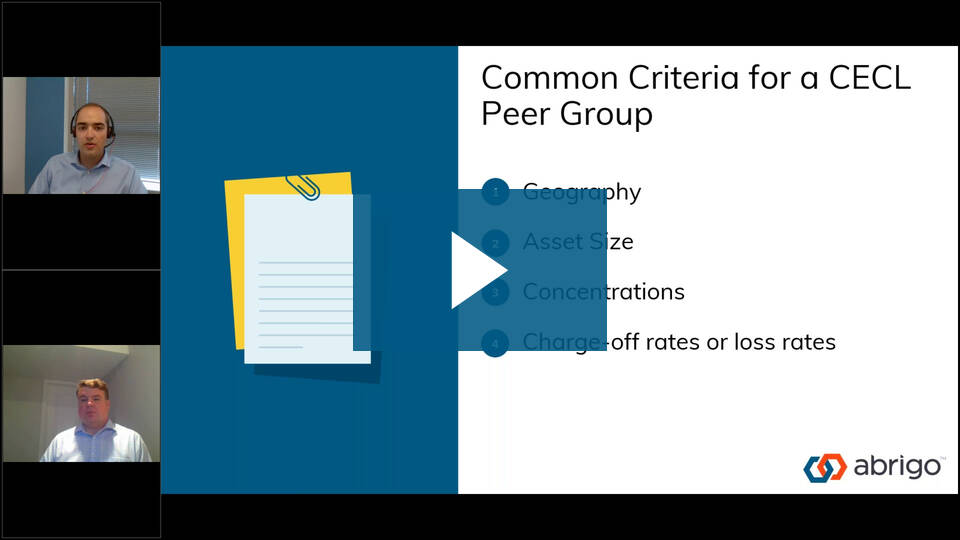

- How to assess the need for external data when building credit models

- Why existing peer cohorts may not be applicable

- How to balance relevancy and usefulness in constructing a peer cohort

- Key issues to be aware of with public financial institution data sources

- Considerations when selecting peers for use with the “SCALE” concept

Peer Identification for CECL and Other Credit Risk Applications

Jon Thompson

Jon Thompson is a graduate of Tennessee Tech University who started his career with a regional accounting firm focusing on financial institution audits. Later, he moved into industry serving as controller then CFO for an SEC registered Bank, managing all internal and external reporting with responsibilities for allowance for loan