You can’t just plant a seed in the ground and expect to have a plant the next day. There are several factors you have to consider in order for it to develop, from planting it in the proper soil and getting the right amount of light, to watering it and fertilizing it correctly. Similarly, growing your financial institution’s loans is more than just a goal. It takes a significant amount of care and consideration to ensure that loan growth can be supported, including having the funds to do so.

Core deposits play an important role in providing funding for financial institutions’ loan growth. Because of this, relationship pricing can be an essential approach to acquiring funds for loan growth.

Let’s imagine that your institution has a goal of hitting 10% ROE and 1% ROA, and it has a customer seeking a 5/20 balloon commercial real estate loan of $1,200,000. After pricing the loan to be competitive in the market, assigning credit risk value, and adding up annual service fees, the ROE falls short of the 10% goal at 4.85% and the ROA is just shy of the 1% target at 0.97%.

Let’s imagine that your institution has a goal of hitting 10% ROE and 1% ROA, and it has a customer seeking a 5/20 balloon commercial real estate loan of $1,200,000. After pricing the loan to be competitive in the market, assigning credit risk value, and adding up annual service fees, the ROE falls short of the 10% goal at 4.85% and the ROA is just shy of the 1% target at 0.97%.

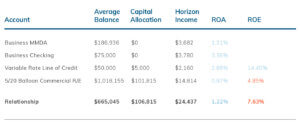

The combined return in this example would improve to 5.30% ROE and 1.06% ROA. You could continue, taking into account the value that adding a business checking account or money market deposit account would add to the overall return on the relationship. In this scenario, doing so would mean that the value of each of the additional products could help the financial institution exceed its ROA target (hitting 1.22%) and fall just shy of the ROE goal (achieving 7.63%) on the entire relationship.

The combined return in this example would improve to 5.30% ROE and 1.06% ROA. You could continue, taking into account the value that adding a business checking account or money market deposit account would add to the overall return on the relationship. In this scenario, doing so would mean that the value of each of the additional products could help the financial institution exceed its ROA target (hitting 1.22%) and fall just shy of the ROE goal (achieving 7.63%) on the entire relationship.