While bankers might have hoped the close of 2021 would also bring an end to the challenging rate environment and the pandemic, it’s clear financial institutions will spend the coming year facing the continued effects of both. The unusual circumstances make effective loan pricing more imperative than ever for banks and credit unions.

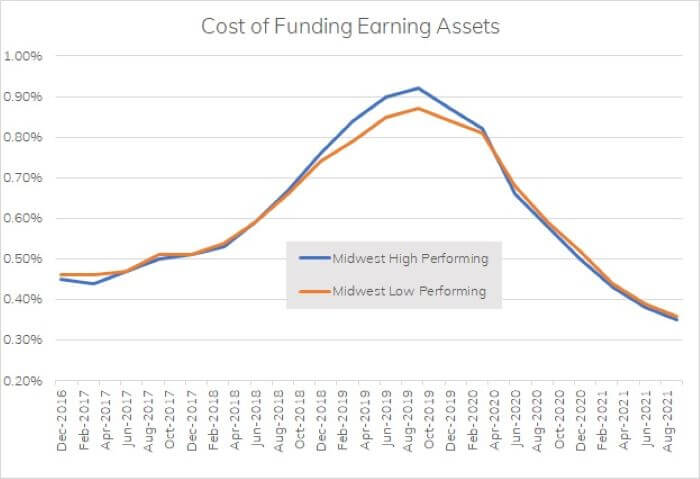

Excess liquidity is persisting into 2022, affecting balance sheets and capital and squeezing net interest margins further as banks and credit unions deploy more assets in the lower-margin investment portfolio or in plain cash. Although they were up slightly in the third quarter from a record low, annualized net interest margins are nevertheless 25% below those in 2018. And if you are holding out and banking on future rate increases to help, you are likely to be disappointed. Future rate increases are likely, given the Fed’s recent actions and the persistent inflation. However, we believe that smaller margins are a fact of life for us - the most recent rising rate environment of 2016-2019 had almost no effect on raising net interest margins.

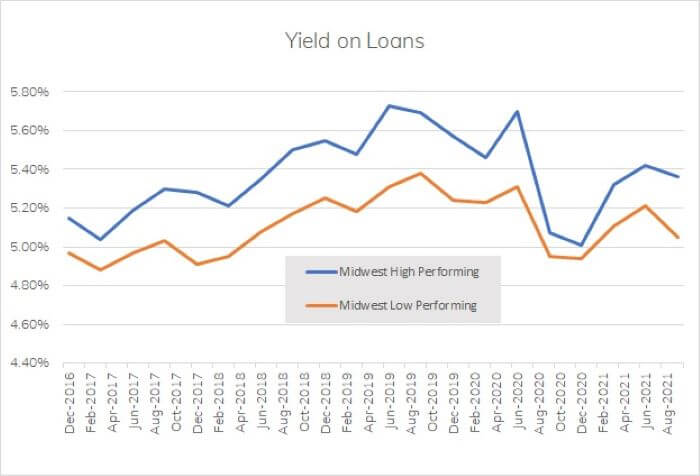

The liquidity boom and slow loan growth have also forced more competitive rates in some sectors, such as 1-4 family residential loans. That, in turn, has additionally pressured yields, despite record-low cost of funds.

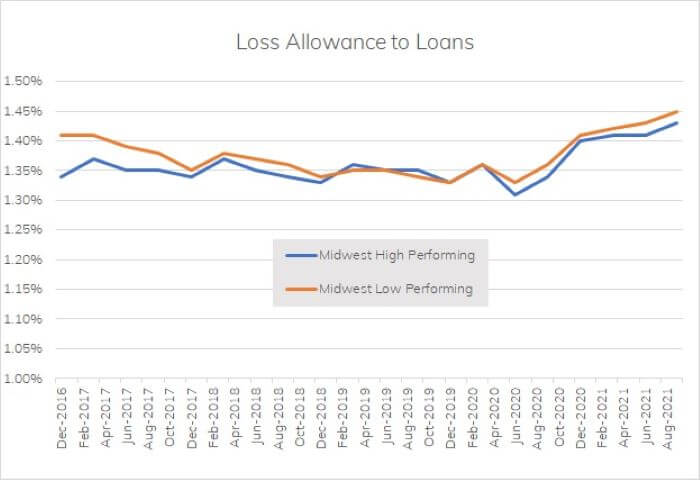

Meanwhile, the adoption of the current expected credit loss model, or CECL, is prompting a re-evaluation of credit risk spreads and how those will affect loan pricing and profitability. We’ve spoken to institutions who expect to see noticeable increases in reserves in some lending categories, which eventually have to be paid for in margin.

For financial institutions that rely on interest rate increases to boost loan yield and thus avoid taking on duration risk in the meantime, the lessons from recent history show that this is a potentially high-risk strategy because increases in short-term rates can affect funding costs just as much as they help loan yields. Nevertheless, planning adequate loan yield in the months ahead is critical for a successful year, given that 75 to 80 percent of net income comes from net interest margin.

Meanwhile, fintechs will continue to promote low-fee transaction products, and financial institutions will respond to the competitive pressure, so banks and credit unions will also see added pressure on non-interest income.