FASB Gives Breathing Room on CECL to Smaller SEC Filers, Private Cos

As CECL is implemented, the allowance for loan and lease losses, or ALLL, is being called the allowance for credit losses, or ACL.

Small public banks, privately held banks, and credit unions will get extra time to get CECL right, based on a move by the Financial Accounting Standards Board Wednesday.

The FASB took the first step toward providing at least an extra two years for smaller public companies and an extra year for all private financial institutions to implement the current expected credit loss standard, with members saying they expect the longer timeframe to promote a higher quality, smoother implementation.

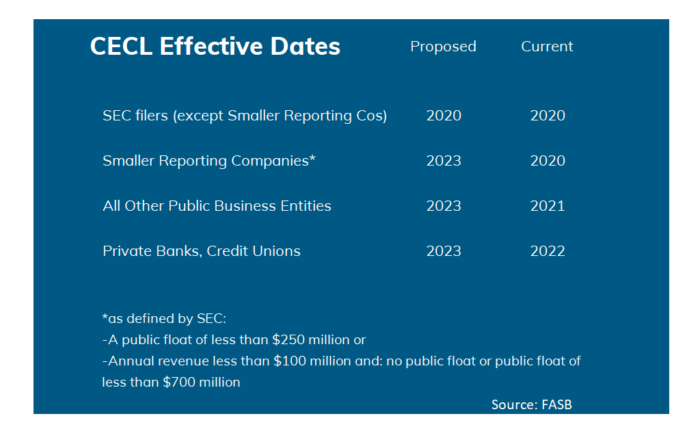

FASB members unanimously agreed in principle to give all but the largest U.S. Securities and Exchange Commission filers until January 2023 for CECL implementation. Once finalized with a board vote, likely sometime later this year following a 30-day comment period, CECL deadlines for various financial institutions would be as follows:

• Smaller reporting companies, as defined by the SEC: January 2023, compared with the current effective date of January 2020. The SEC defines a Smaller Reporting Company as one that has a public float of less than $250 million or has annual revenue of less than $100 million as well as either no public float or a public float of less than $700 million. The FASB staff said the eligibility would be based on a company’s SEC status as of the date FASB formally approved the change to the CECL effective dates. Public float is calculated by multiplying the number of common shares held by non-affiliates by the market price.

• Other public business entities: January 2023, compared with the current effective date of January 2021.

• All others (privately held banks and credit unions): January 2023, compared with the current effective date of January 2022.

Only SEC filers that do not fit the SEC’s definition of a smaller reporting company would be required to implement CECL under the original deadline of January 2020.

More time for better CECL implementation

FASB staff recommended the larger gap in implementation between large SEC filers and all others, saying it would help ensure companies obtain better data, build more robust internal controls, learn from results of SEC filers, and perhaps approach CECL implementation as a business solution.

That last concept resonated with board member R. Harold Schroeder, who said it came up in his discussions with banks. “They talk about, “Yes, we can apply the standard and do a compliance approach and get the number right, but if we want to integrate the information into our business and use it for making good business decisions, we need more time,’” he said. He endorsed providing additional time for institutions to implement CECL in “a more thoughtful manner.”

The FASB staff noted in its background research that some smaller companies encountered magnified challenges and costs transitioning to some accounting standards due to their ability to access resources, educational sources, technology expertise and other factors.

Regan Camp, Abrigo Managing Director of Advisory Services, said that despite the deadline being pushed back for many banks and credit unions, the new implementation date would arrive quickly.

“Financial institutions should be cautious about taking the foot off the gas pedal, especially if they have already formed a CECL steering committee or started down the path of any type of data gap assessment or building a model or engaging with a third-party solution,” Camp said. “Some people are going to embrace any delay as ‘I’m going to hurry up and wait, and we’ll get started a couple of years down the road.’ Then in three years, they’ll be on the sidelines with their fingers crossed hoping to get additional relief. We have to remember that we’ll be held accountable for the time we’ve been given. If we’re sitting there saying we don’t have sufficient data to produce a meaningful model, they’ll say, the standard was released in 2016 and you were given additional relief in 2019 and now you don’t have sufficient data and no program?”

More CECL educational opportunities

The FASB also announced plans to provide additional outreach to financial institutions starting later this year to make sure that banks and credit unions, regulators and auditors are on the “same page” when it comes to CECL implementation. The board directed staff to begin planning workshops around the country for additional training. It also released a new document answering frequently asked questions about CECL, which is considered the biggest change to bank accounting in the industry’s history.

Abrigo will offer several opportunities for financial institutions to learn more about the FASB’s meeting and how institutions can transition from here, whether they have begun implementation or haven’t. Sign up for an audio debriefing on the FASB meeting here.

Neekis Hammond, CPA, Managing Director of Abrigo Advisory Services, said the updated implementation dates would be very helpful to organizations. However, even with increased internal resources, SEC filers “will use every minute of the allotted June 2016 – December 2019 timeframe,” or 3.5 years, he noted. “Hopefully, affected institutions will use the updated implementation timeline to implement. The worst-case scenario is that institutions interpret this as an opportunity do nothing for an additional 12-24 months. After all, with presumably limited internal resources, if SRCs and private/non-profit entities tried to implement in a significantly shorter timeline than SEC filers, it may troublesome for their staff.”

“Based on our experience, an approach that allows for a 4-quarter parallel exercise is incredibly helpful in monitoring volatility, back-testing, and documenting controls,” Hammond said. “Having a partner selected in 2019/2020, working through data analysis and remediation in 2020/2021, model selection and sensitivity testing in 2021/2022, and parallel operations in the latter part of 2022 would be a prudent plan. Condensing such a plan would put significant constraints on key people and processes within these organizations.”

Read Abrigo’s whitepaper, “WARM or Remaining Life: A Viable CECL Methodology for Some Financial Institutions,” or visit our Knowledge Center for webinars, whitepapers, and additional articles about CECL.